Each and every child is entitled to five basic rights: the right to play, recreation, family life, education, and health. Nigeria is a signatory to the agreement of United Nations Convention on the Rights of the Child (UNCRC) yet education is still considered a privilege. For the parents and students of Osun State, it is a burden.

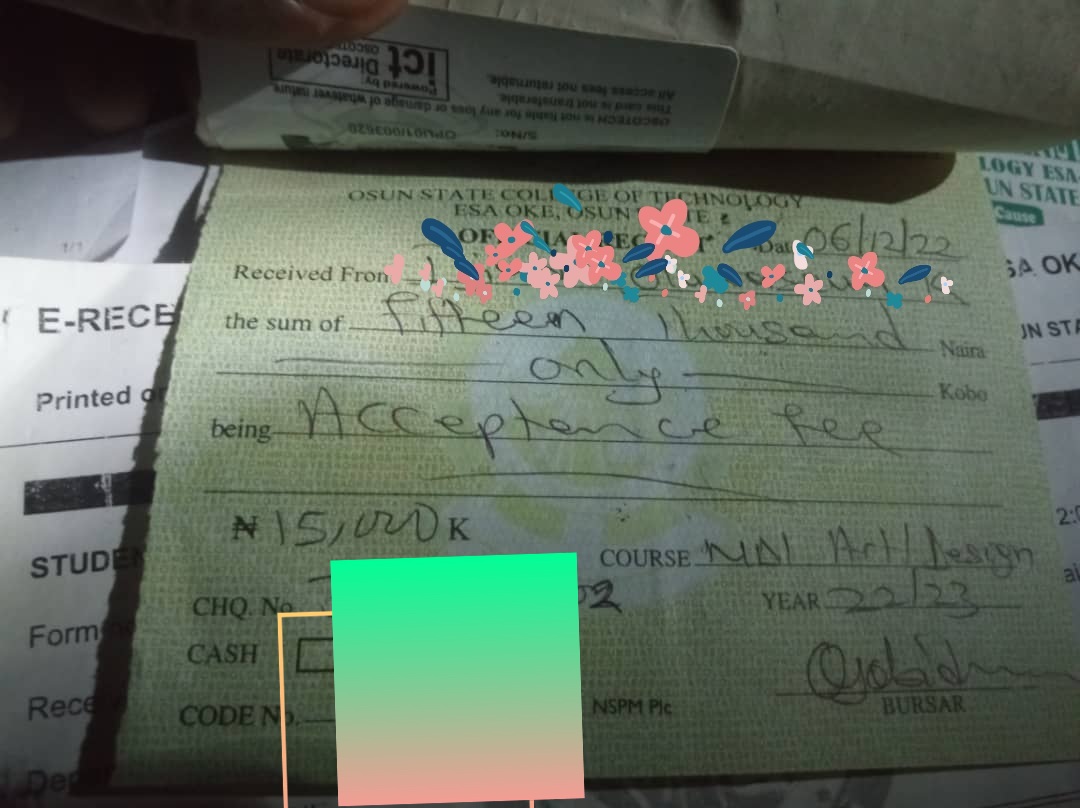

Students at state-owned universities submit the Tax Clearance Form after they may have already paid the tuition and an admission fee of between N15,000 and N20,500 as a “thank you” gift to the school for accepting them.

Article 1(2) of the Convention Against Discrimination in Education (CADE, 1960) defines education as all forms and degrees of learning, including access to learning, learning standards and quality, and learning environments.

The appalling condition of education facilities in tertiary institutions, which includes, among other things, deteriorating infrastructure, a dearth of well-equipped laboratories, shoddy classroom furnishings, a bad road system, and a poor water supply. These show that the state’s educational standards do not match the amount that students must spend for their education.

Findings, however, showed that the Osun State College of Technology, Esa-Oke, cancelled the Tax Clearance Form payment only four years ago due to strong opposition from the students during the Adegboyega Oyetola-led administration.

This report not only exposes how much money students pay for their education—between N9,000 and N15,000—but also how the government takes advantage of them by charging them between N9,000 and N15,000 for “Tax Clearance Forms,” which opens the door for outside parties to bribe.

I await my salary as a part-time barman to pay for Tax Clearance Form, says Jeremiah

Despite having paid N10,000 as an acceptance fee and N79,200 as school fees, Jeremiah, who is only twenty-one years old, is still unsatisfied. This 21-year-old student is hustling and pleading for more money. Her parents are small-time farmers who had to spend all of their savings on tuition. Because he hasn’t deposited the N9,000 into the Osun State Government’s accounts, Jeremiah is unable to submit his paperwork for documentation.

I’m a bartender by night. I’m waiting for my pay. I don’t have the money to pay for the tax clearance form till they pay us at work. Although I asked friends and family for assistance, they were unable to assist me. Jeremiah told WITHIN NIGERIA, “I think the bad economy has affected them too.”

Jeremiah’s story is comparable to the accounts of a number of state pupils. Many students reported that they had not made the Tax Clearance Form payment. While some students declared they were in debt, others described the struggles they had before they could make a payment.

A student at Osun State Polytechnic’s Civil Engineering Department, Iree, simply known as Kunle, informed this reporter that before he could submit his file, he had to go to the Iragbiji tax office and pay the sum of N12,000 in cash.

Staff members at the administrative building, according to Kunle, would not pick up any files without the tax clearance paperwork.

I renewed my tax clearance form with N7,000 – Olaide discloses

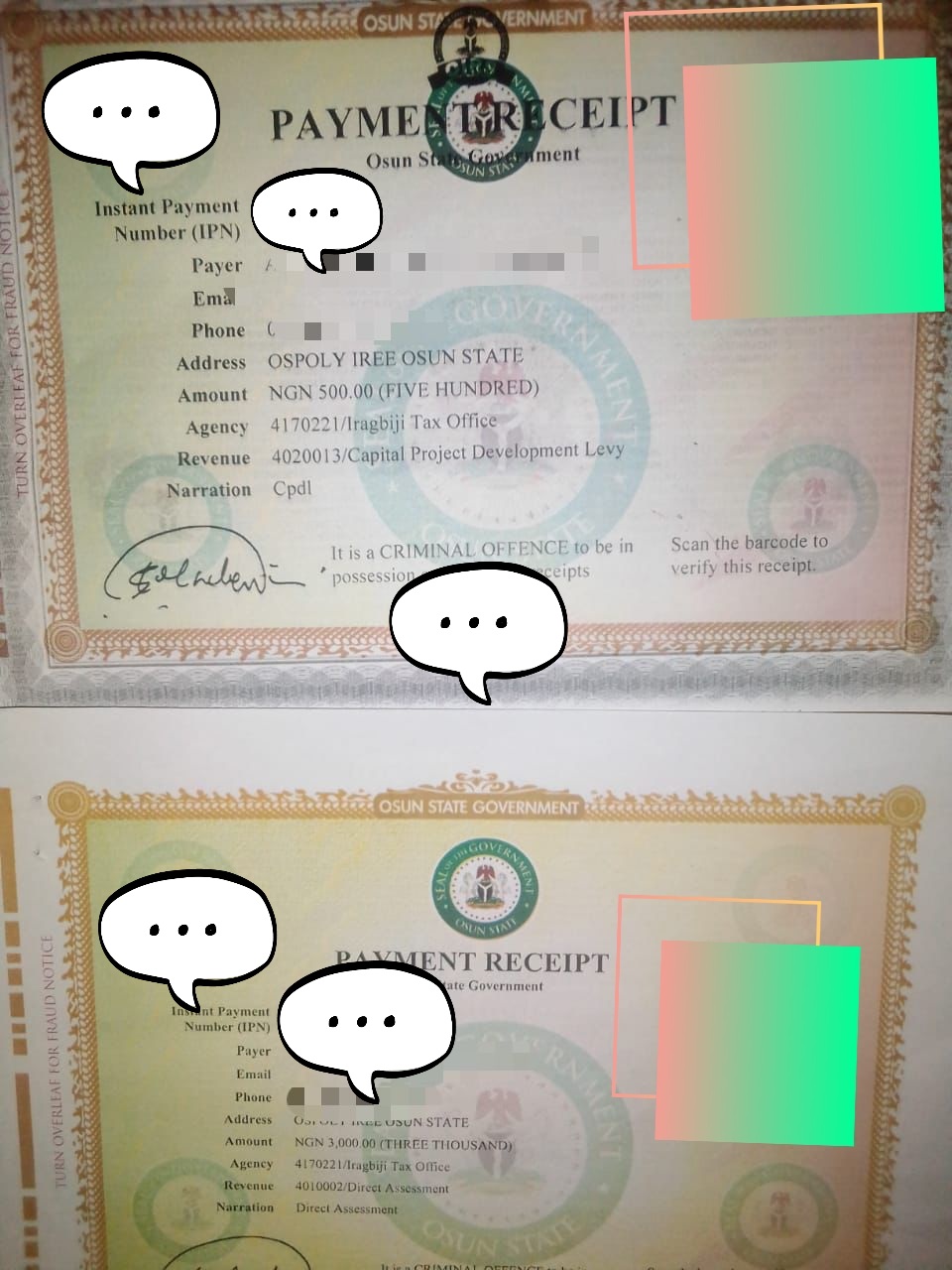

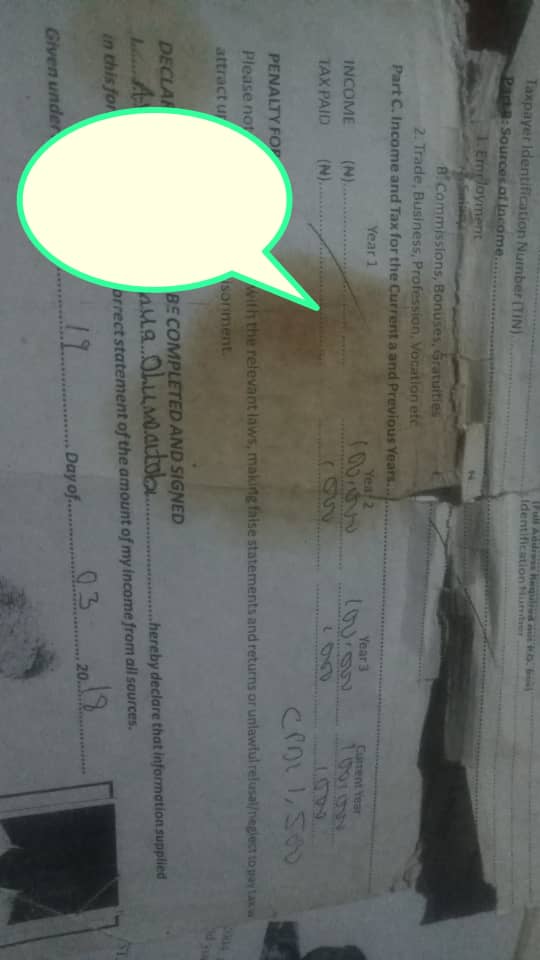

This is not the case with Olaide (not his real name). He is an Osun State Polytechnic, Iree alumnus returning to school. He told the reporter that he paid N7000, but he also received two receipts with the state government’s name and emblem on them, along with the following information: N3,000 for direct assessment and N500 for capital project development levy.

Every receipt or tax clearance form has an expiration date within the year of issuance. If the academic calendar is not affected by a strike or other delays, a tax receipt can be used for two sessions. In the event that a new school year begins in a different year, renewal is required. Olaide went on, “I renewed my tax receipt with the amount of N7000, but the receipt showed N3500.”

I paid N15,000 at Osogbo tax office, Remi reveals

A student at Osun State University’s Osogbo campus named Remi revealed that he paid N15,000 at the Osogbo tax office.

The procedure is easy to follow. Simply bring pictures of your parents or guardians tax clearance forms to any local government office in the state. Remi said that you can obtain the tax clearance receipt promptly by paying N15,000.

A recent graduate of the Osun State College of Health Technology, who went by the name “Ade,” showed the reporter his own receipt and bemoaned how it had completely drained his bank account and made it difficult for him to survive.

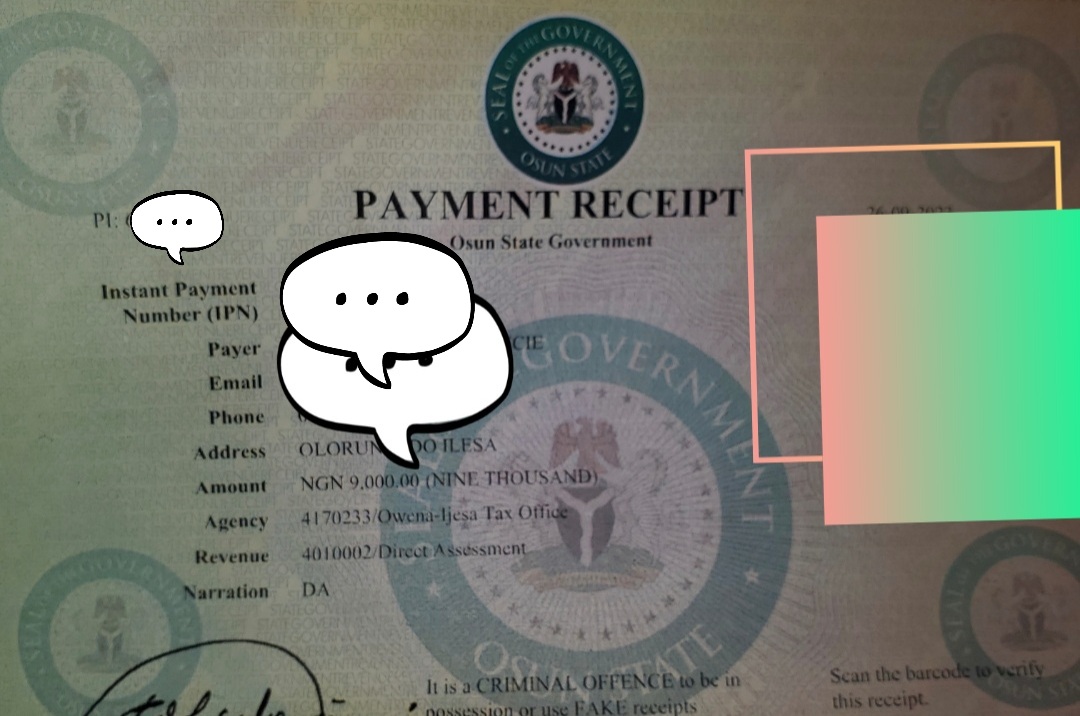

Ade went on to say that although the employees at the Owena-Ijesha Tax Office had taken N11,000, he had only seen N9,000 on the receipt following payment.

I did not pay for any Tax Clearance Form, OSCOTECH student admits

Jibola, a 19-year-old Fine Arts student at Osun State College of Technology, Esa-Oke, told the reporter he didn’t seek for a Tax Clearance Form and didn’t pay a kobo when he was called.

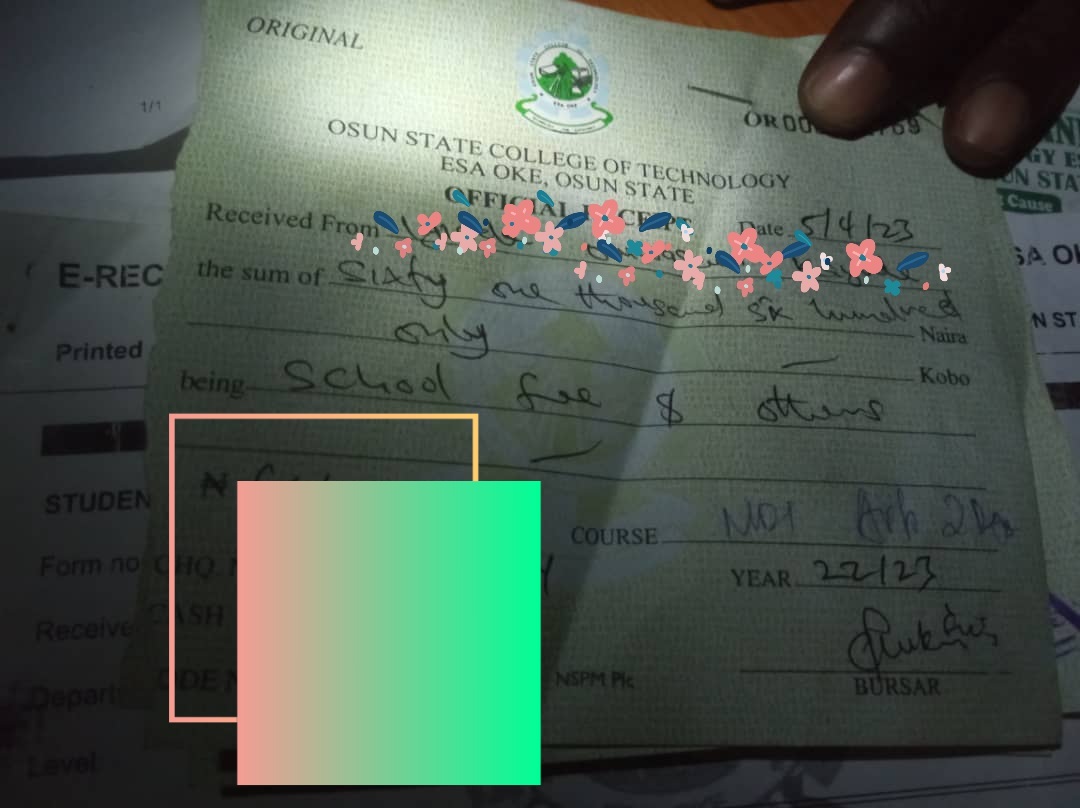

I simply paid the acceptance fee of N15,000 and the school fees of N61, 600. I also cover the department, faculty, and SUG dues. The student, 19, said, “I didn’t pay a dime or go to any tax office.”

Borrow tax receipts with similar surnames and bribe staff with N2,000 or more

A student who wishes to remain anonymous told the reporter that because they have the same surname, she was fortunate to be able to utilize a tax clearance form or receipt from his uncle, a public worker.

I brought the form to our school’s administration building. They examined the form and contrasted its information with mine. The Osun Poly Iree student said, “Even with the obvious similarity, I still had to pay the officer on duty the amount of N2500 to scale through the process.”

Another student, going by the name Mayowa, revealed that he was required to look for a civil servant with the same last name as him.

After searching for days, I was fortunate. I pleaded with the person, and he let me use it. Mayowa, a student at UNIOSUN, revealed, “I still had to bribe the officer in charge with N1500 to fast track the process, and I believe that others would do same too.”

Adebimpe paid N5000 to the people in charge of gathering papers, and she was permitted to attach a tax clearance document that is unrelated to her by name or blood.

Origin of Tax Clearance Form in tertiary institutions

According to research conducted by WITHIN NIGERIA, Rauf Aregbesola, the previous governor of Osun State, introduced the Tax Clearance Form into the state’s educational system.

The tax clearance form is available to parents who pay taxes to the government and are residents of Osun State. According to this policy, students or wards of these parents or guardians may show a tax clearing form as proof of paid taxes, while those whose parents or guardians do not have one must pay a certain amount to any state tax office.

Subsequent investigation showed that students who were unable to produce the tax clearance form paid between N3500 and N5000, while those who were able to do so paid the amount of N1500.

Despite providing a relative’s tax clearance form, a student who supplied a document proving it was a tax clearance form informed the reporter that he had paid N1500 at the administrative building as of March 19, 2018.

The Osun Governor’s Senior Special Assistant on Student Matters, Comrade Oladejo Basiru, responded to the development by revealing that there is no mandate for tax payment among students attending state-run higher education institutions.

Basiru, who informed the reporter that he frequently meets with union presidents, added that he hasn’t heard anything about it from any student leaders and questions the veracity of these statements.

He said that students should just bring their parents’ or guardians’ tax clearance papers to their respective institutions.

Taxes are necessary for development and progress, says Osun Education commissioner, Eluwole

The state’s Honorable Commissioner of Education, Mr. Dipo Eluwole, confirmed the development when called and added that taxes are necessary for development and progress.

“There is no fuel in Europe, the UK, or Canada.” They are reliant on IGR and taxes. Nigerians do not pay taxes. It became required for all students and learners. Whenever we wanted to do something at school, we had to bring our parents’ tax clearance forms’, he further stated.

According to Eluwole, having tax clearance and falling into different categories is not a huge concern for parents.

Eluwole stated that it is dependent upon qualifications and level. It was done specifically to encourage tax payment, as doing so would increase the amount of money available to the government for initiatives.

When questioned about why Osun State College of Technology, Esa-Oke students did not present tax clearance forms or were not asked to pay for the forms, Eluwole responded that, should this claim be verified, the institution’s rector, Samson Adegoke, will face consequences because a circular was issued for this purpose, and all educational institutions, including elementary schools, were instructed to follow it.

Refuting the notion that students pay taxes, Eluwole told WITHIN NIGERIA that parents were requested to pay in the event that the students lacked a tax clearance form, rather than the students being told to do so.

It only requires them to bring their parents’ tax clearance document. He said that if your parent works for the government, all you need to do is get a photocopy of their paperwork, send it in, and pay the tuition.

The Commissioner quickly interrupted the call by telling the reporter that he had a lot of obligations to attend to after being questioned about the requirement that students whose parents are not civil servants pay between N9,000 and N15,000 to obtain a tax clearance form.

Discussion about this post