- CBN introduced Cybersecurity levy on May 6

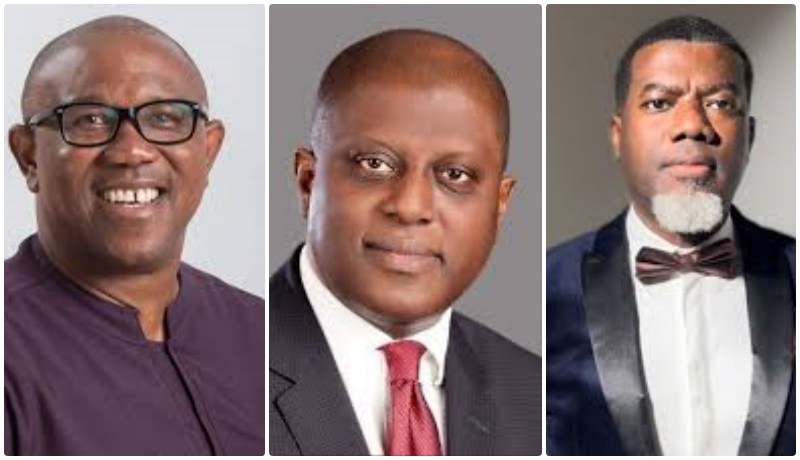

- Obi, TUC, Northern Coalition group kick against the policy as Reno Omokri says it is right in a right direction

- House of Reps intervene, ask CBN to suspend the levy indefinitely

On Monday, May 6, 2024, the Central Bank of Nigeria, CBN introduced CyberSecurity levy.

The circular directed to all commercial, merchant, non-interest and payment service banks, among others, revealed that it was a follow-up on an earlier letter dated June 25, 2018 (Ref: BPS/DIR/GEN/CIR/05/008) and October 5, 2018 (Ref: BSD/DIR/GEN/LAB/11/023), respectively, on compliance with the Cybercrimes (Prohibition, Prevention, Etc.) Act 2015.

According to the apex bank, it will begin the implementation of an amended 2015 Cybersecurity Act that will levy a 0.5% fee on all electronic transactions from May 20, an increase of 900% from an earlier levy of 0.005%.

WITHIN NIGERIA findings showed that this means an electronic transfer of ₦1,000 will attract a ₦5 fee while a ₦100,000 transfer will attract a ₦500 fee.

The cybersecurity levy will be charged in addition to existing fees like stamp duty, a ₦50 charge on electronic receipt or transfer of money in any deposit money bank or financial institution on sums of ₦10,000 or more.

It was gathered that in a matter of two weeks when the levy goes into effect, it will have only a few exceptions which include money transfers within the same bank, salary payments, school fees payments, and loan repayments.

Expectedly, financial experts argue that the new levy will constitute a burden for low-income earners who rely on electronic transactions for daily activities.

Investigations revealed that the value of electronic transactions in Nigeria rose by 66% to over N600trillion in 2023, according to the Nigeria Inter-Bank Settlement System (NIBSS).

The Cybersecurity Act was first passed in 2015 and introduced a 0.005% levy on electronic transfers.

However, in June 2018, CBN memo directed banks to collect the levy on “electronic transactions occurring in a bank or on a mobile money scheme or any other payment platform that have an accompanying service charge.”

In 2024, the Act was amended and the levy was increased by 900% to 0.05% and it extended the levy to cover fintechs, payment service providers, and other financial institutions.

By and large, on May 3, the National Security Adviser, Nuhu Ribadu called for an implementation of the amended act, highlighting the increased influence of the NSA. The cybersecurity levy will be remitted monthly to the National Cybersecurity Fund (NCF), managed by the NSA.

This arrangement to say the least is in contrary with the provision of the Act which states that the levy will be held by the CBN for on ward remittance to the Federal government.

List of the exempted banking transactions:

However, according to the CBN, there are some exceptions to the said cybersecurity levy which include, Loan disbursements and repayments,Salary payments, Intra-account transfers within the same bank or between different banks for the same customer and Intra-bank transfers between customers of the same ban, Other Financial Institutions instructions to their correspondent banks and Interbank placements.

Others are Banks’ transfers to CBN and vice-versa,Inter-branch transfers within a bank, Cheque clearing and settlements, Letters of Credits, Banks’ recapitalisation-related funding – only bulk funds movement from collection accounts, Savings and deposits, including transactions involving long-term investments such as Treasury Bills, Bonds, and Commercial Papers.

Also excepted are Government Social Welfare Programmes transactions e.g. Pension payments, Non-profit and charitable transactions, including donations to registered non-profit organisations or charities, Educational institutions’ transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions, Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.

Reactions of Nigerians

Nevertheless, few hours after the release of the directive, many Nigerians started kicking against the levy, describing it as another way milking the poor citizens. The levy has continued to generate a lot of divergent views across both political and economic spectrum of the society.

In any case, the presidential candidate of the Labour Party, in the 2023 general election, Peter Obi, has described the newly introduced the levy by as one tax too many.

He noted that the tax is ill conceived and designed to milk a dying economy.

Mr. Obi said this in a series of tweets on his X handle, on Wednesday.

According to him, the Federal government should focus more on nurturing the economy back to health and growth, rather than the current administration introducing multiple taxation.

He further alleged that the Federal government is more interested in heaping additional burdens on Nigerians who are already under severe economic stress.

In his words, “the introduction of yet another tax, in the form of Cybersecurity Levy on Nigerians who are already suffering severe economic distress is further proof that the government is more interested in milking a dying economy instead of nurturing it to recovery and growth.

“This does not only amount to multiple taxation on banking transactions, which are already subject to various other taxes including stamp duties but negates the Government’s avowed commitment to reduce the number of taxes and streamline the tax system.

“The imposition of a Cybersecurity Levy on bank transactions is particularly sad given that the tax is on the trading capital of businesses and not on their profit hence will further erode whatever is left of their remaining capital, after the impact of the Naira devaluation high inflation rate.

“It is inconceivable to expect the suffering citizens of Nigeria to separately fund all activities of the government.

“Policies such as this not only impoverish the citizens but make the country’s economic environment less competitive.

“At a time when the government should be reducing taxes to curb inflation, the government is instead introducing new taxes. And when did the office of the NSA become a revenue-collecting center?

Trade Union Congress frowns at the levy

The TUC described the levy expected to take effect within two weeks from May 6, as a vexatious extortion of the masses that should not be allowed to stand.

The TUC took a swipe at President Bola Tinubu’s administration for policies that had brought pain, anguish and sorrow to Nigerians, gave the federal government an ultimatum to give marching orders to the CBN to immediately withdraw the circular and cancel the planned levy.

The labour movement threatened that if the planned implementation of the 0.5 per cent cybersecurity levy was not cancelled, it have no other option than to mobilize all its members, stakeholders and the entire masses to embark on the immediate protest that would culminate in a total shutdown of the nation’s economy.

In a statement signed yesterday by the President, Comrade Festus Osifo, the TUC alleged that so many policies of the government were not only imposing hardship on downtrodden Nigerians but also businesses, as some of them were shutting down because of the unfriendly business environment.

The statement entitled, “Cybersecurity Levy: This Extortion is Vexatious and will not stand,” partly read: “The Trade Union Congress of Nigeria, TUC, has received with rude shock the recent directive by the Central Bank of Nigeria, CBN, in a circular to banks imposing a 0.5 per cent cybersecurity levy on almost all electronic transactions.

“It is, indeed, illogical that this is coming at a time Nigerians are grappling with the high cost of living that is imposed by the devaluation of the naira, hyper hike in the cost of petrol, supersonic increment in the cost of electricity tariff, etc.

“We are quite disturbed that since the inception of this administration, its policies have brought pain, anguish and sorrow to Nigerians. Whereas a bank account holder in Nigeria today is currently charged stamp duty, transfer fee, VAT on transfer fee, and all forms of account maintenance levies by both government and the banks, this burden seems not to be enough as the government is poised to inflict further pain on the already battered Nigerians.”

Accusing the government of stifling the business environment, the TUC said: “So many policies of this government are not only imposing hardship on the downtrodden Nigerians but also businesses, as some of them are shutting down because of the unfriendly business environment.”

It accused the National Assembly of not being alive to its responsibilities, alleging that the federal lawmakers conspired with those exploiting the masses to inflict more pain on them.

TUC stated further: “The National Assembly that ought to be the bastion of democracy and the protector of the citizens oftentimes engages in collusion with elements within the executive to exploit the people.

“How can such obnoxious law see the light of day in a truly people-oriented legislative house? This is indeed, a conspiracy of the oppressors against the masses and citizens of this country and it must be resisted by all well-meaning Nigerians.

“Financial analysts have done a preliminary estimate, using the 2023 online transfer volume in Nigeria that fell within these categories and put the value at over N2 trillion. What kind of cybercrime are we fighting with this humongous amount of money?

“This ugly development will further encourage people to hoard cash at home, reduce financial inclusion, increase poverty and exacerbate the misery index.

“The cost of living is at an all-time high, food inflation is biting, all contributing to the miserability of Nigerians. This act is viewed as a deliberate plot to continue to drain Nigerians of their hard-earned money and we kick against this vehemently.”

“We call on the federal government to give a marching order to the Central Bank of Nigeria to immediately withdraw the circular and cancel the planned levy forthwith; failure of which we will be left with no option than to mobilize all our members, stakeholders and indeed the entire masses to embark on the immediate protest that would culminate into the total shutdown of the Nigerian economy as this is one exploitation too many. Enough is enough, Nigerians must breathe! This extortion must stop,” TUC added.

Northern Coalition says it is unacceptable

Similarly, the Coalition of Northern Groups, CNG, also rejected the proposed imposition of a 0.5% cyber security levy on every electronic transaction in the Nigerian banking system.

A statement by the National Coordinator, CNG, Comrade Jamilu Aliyu Charanchi, said the levy could worsen the plight of many Nigerians already going through tough economic conditions.

According to him, “This levy, which is expected to be effective within the next two weeks, exemplified the federal government’s lack of compassion and empathy to the plight of Nigerians in the face of the current economic hardship.

“It is crass heartlessness that is the sequel to fuel subsidy removal which now made fuel above N1000 per litre and electricity tariff’s abrupt soaring that is tantamount to another daily-light extortion in the offing by the government that came to be through democratic processes.

“The CNG describes the policy as totally unacceptable extortion that is callously being burdened on Nigerians who are already suffering from neoliberal exploitations through the government’s thoughtlessness to the plight of the downtrodden.

“We believe this additional charge is completely unjustifiable as Nigerians are already being fleeced through collection of stamp duty, transfer fee, VAT, and SMS charges in the Nigerian banking sector.

“While we concur that securing our cyberspace is paramount, that can only be justified as a corollary to the stabilization of the economy and improvement of the standard of living of Nigerians.

“Even at that, the current 0.5% per cent is quite exorbitant in a country that has not fully implemented N30,000 minimum wage but has reportedly raised the disposable income of members of the National Assembly.

“We regret that the government had already strangled the people from any derivable benefit in healthcare, education, fuel subsidy and agriculture to the point that millions of Nigerians cannot afford decent living in whatever form.

“The CNG observes that Nigerians are already swimming in despicable stringent conditions consequent to the government’s ill-advised policies that have weakened people’s purchasing power.”

The coalition further said that “we call on the national banker as a matter of principle and transparency, instead of further depleting the lean resources of struggling but resilient Nigerians, to provide a detailed explanation of all the stamp duty charges accrued from the banks in the last 10 years.

“Therefore, we counsel the CBN to reconsider this ill-conceived policy and explore alternative solutions that do not further extend Nigerians.”

House of Representatives clarifies the levy

The Chairman, House of Representatives Committee on Information and Communications Technology (ICT) and Cyber Security, Hon. Adedeji Dhikrullahi Olajide, has clarified the provisions of the Cybersecurity Act, assuring Nigerians of his commitment to their well-being.

In a statement by his Special Adviser on Media and Public Affairs, Tolu Mustapha the lawmaker said the concerns raised by various stakeholders, including citizens, government agencies, and private organizations are well noted.

According to him, the Cybercrime (Prohibition, Prevention, etc.) (amendment), signed into law in 2024, aims to protect Nigeria’s digital space from cyber threats, promote cybersecurity awareness, and establish a framework for incident response.

Hon. Adedeji Olajide, who chairs the committee overseeing the implementation of the Act, emphasized that the legislation is designed to strike a balance between national security, citizens’ rights, and economic growth.

According to him, “Our goal is to create a safe and secure digital environment for all Nigerians, while also respecting their privacy and freedom of expression,” he said.

“The levy will be a small percentage of telecom operators’ revenue, and will not burden citizens or businesses,” he assured.

He further dis-abused concerns about potential abuse of power, and highlighted the establishment of an independent Cybersecurity Council, which will oversee the implementation of the Act.

“The Council will comprise representatives from various stakeholders, including government agencies, private sector organizations, and civil society groups, to ensure transparency and accountability,” he said.

Olajide also stated further that the Act makes provision for the safeguard and protection of citizens’ privacy.

“Any surveillance activities will be subject to judicial oversight and must meet strict criteria to ensure that individual rights are not violated,” he said.

The committee chairman also acknowledged concerns about the potential impact on small and medium-sized enterprises (SMEs), which are the backbone of Nigeria’s economy.

“We are working with relevant agencies to ensure that SMEs are not disproportionately affected by the levy or other provisions of the Act,” he assured and reaffirmed his commitment to the well-being of Nigerians, “As Chairman of this committee, I am dedicated to ensuring that the Cybersecurity Act serves the interests of all citizens, while also supporting economic growth and national security.”

Reno Omokri says it is for the good of the citizenry

In the same vein, Reno Omokri, a former presidential aide, has said that the newly introduced cybersecurity levy by the CBN is for the good of Nigerians.

He stated this on his X handle on Wednesday, 8th May, 2024.

According to the socio-political analyst, the levy aims to safeguard the Naira against various economic threats and manipulations.

Omokri emphasized the importance of the levy and clarified that it was not a policy introduced under President Tinubu’s administration but has been in place since 2015.

He further argued that without this policy, Nigeria’s cyberspace would be vulnerable to cybercrimes and other criminal activities.

Omokri wrote, “The Cybersecurity Levy is For Your Own Good.

“This Cybersecurity Levy is not a policy or regulation of the Tinubu administration. Those bandying that claim are either ignorant or dishonest. This is a policy that has existed since 2015. Like many things in the Buhari administration, it was implemented in breach, which is why Cyber Security suffered under that unfortunate administration.

“The reason why Binance was able to siphon $25 billion, which represents 6% of our GDP, out of Nigeria in just one year is because our cybersecurity architecture is porous. And as long as it is vulnerable, the Naira cannot be stable. And if the “Naira is not stable, your purchasing power as a Nigerian will reduce DRASTICALLY.

“Therefore, it is more profitable for you to pay a 0.5% cybersecurity levy and secure the Naira from all threats, foreign and domestic, than for you to resist the policy, and the Naira goes into free fall. Not all monetary transactions are affected.”

Stressing further, Mr. Omokri said that “Social welfare schemes, such as the grant to nano entrepreneurs and any other social intervention program, are exempt, as are charitable donations, and tuition payments.

“Salaries, loans and their repayments, transfers between customers, and intra-bank transfers from one of your accounts to another account you have in a different bank are also exempt.

“If the office of the National Security Adviser does not have a solid and dedicated team working to protect Nigeria’s military, industrial, financial, communications, educational and governmental online space from threats, the cost to you, personally, would be more than the 0.5% levy on your transactions, and I will give you an example.

“If Binance had not been found out, and they had continued to funnel $25 billion out of Nigeria, that singular action would have meant that our Gross Domestic Product (the sum of all the wealth in Nigeria) would have dropped further by 6.5%.

“Now, If Nigeria’s GDP tanks by 6.5% at a go, global ratings agencies like Fitch, Moody’s, Standard and Poor, and others that have recently upgraded our economy to a B Positive, would downgrade us. Once we get downgraded, international investors will not want to invest their money in Nigeria, and the demand for made-in-Nigital goods and services will fall, meaning that the exchange rate will go down.

“Remember MMM? The reason the Mavrodian Mondial Moneybox were able to dupe hundreds of thousands of Nigerians of close to half a billion dollars is because of our weak cybersecurity system.

“And these international carpetbaggers can smell such weakness the way sharks smell blood. When you are bleeding, a predator does not feel sympathy towards you. They see your rupture as an opportunity.

“That is why after MMM duped Nigerians, other Ponzi schemes flooded Nigeria and amassed more daily regular traffic than the best read newspapers in Nigeria, including Ultimate Cycler, Zarfund, Givers Forum, Crowd Rising, iCharity, to mention a few. They all came, they saw, and they duped Nigerians.”

He, however concluded that “The Cybersecurity Levy is For Your Own Good

“This Cybersecurity Levy is not a policy or regulation of the Tinubu administration. Those bandying that claim are either ignorant or dishonest. This is a policy that has existed since 2015. Like many things in the Buhari.”

Meanwhile the House of Representatives has directed the Central Bank of Nigeria (CBN) to stop the implementation of the 0.5 per cent cybersecurity levy on transactions designed to contain growing threats of cybercrime in the financial system.

This resolution follows a motion of urgent public importance moved on Thursday by the Minority Leader of the House, Kingsley Chinda.