The COVID-19 lockdown of 2020 caused market disruptions, fast-tracked digital migration of businesses and triggered significant growth in the number of unicorns globally.

In the capital industry, a unicorn is private startup company that is valued at over one billion dollars.

Available statistics indicate that almost 40 per cent of current unicorns around the world were created in the first eight months of 2021.

The statistics also showed that fintechs and internet software and services produced the highest number of unicorns.

In Nigeria, as recently cited by Vice President Yemi Osinbajo, six startups owned by young Nigerians attained the status of unicorns between 2016 and 2021.

Osinbajo made this closure in his address at the Graduation Ceremony of Senior Executive Course 43, 2021 of the National Institute for Policy and Strategic Studies (NIPSS), Kuru, Jos.

Osinbajo attributed the feat of the startups to providence and good policies.

“Six of those companies started between 2016 in the middle of two recessions and global health crisis.

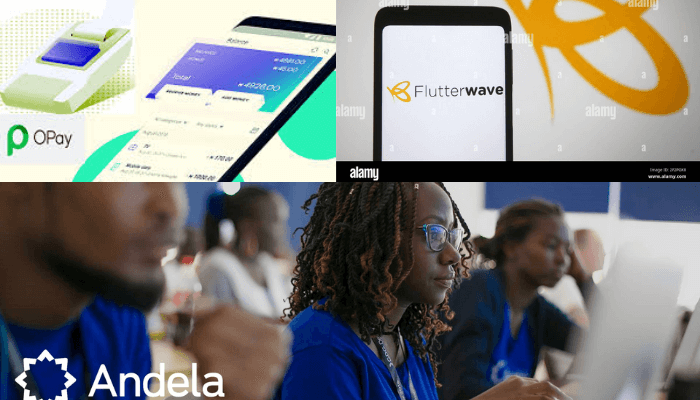

“The companies are: Opay, Paystack, Flutterwave, Andela, PiggyVest and Jumia.

“ Paystack was co-founded in 2016 by two graduates of Babcock University, in their twenties.

“ Paystack is a payment processing company; I am sure many have heard that it was eventually bought over by Stripe, the American multinational; it is now estimated to be worth a billion dollars.

“Flutterwave, also a payment processing company, founded in 2016 in Lagos; it is now worth nearly three billion dollars and both companies employ hundreds of young men and women.’’

He said that PiggyVest was co- founded in 2016 by ex-students of Covenant University, led by 21-year-old lady.

According to him, PiggyVest is a wealth management platform that at the end of 2019, had helped one million users save about 80 million dollars.

“What is responsible for some of these successes? Providence and good policies.

“Providence because COVID-19 was a boom period for online payment systems.

“Policy because the President approved the establishment of a technology and creativity advisory group that helped to formulate new banking policies to accommodate new tech enabled payment systems, such that these tech companies could process payments without being full scale banks.

“The Central Bank of Nigeria (CBN) was then able to issue new types of licences for payment processing; the Federal Government has established a N75 billion National Youth Investment Fund.

“This provides financial support for small businesses in any field.’’

The vice president said that CBN had also established a Creative Sector Fund for young people in entertainment or technology.

He said there was also new programme called Investing in Digital and Creative Enterprises (iDICE).

According to Osinbajo, iDICE is an over 600 million dollars programme that will support young tech and creative sector entrepreneurs through the provision of finance, skills development and infrastructure.

“Earlier this year, the Federal Government partnered the UNDP and the private sector to start a programme called the Jubilee Fellows Internship Programme.

“ For the next five years, every year, 20,000 students after youth service will be given internship opportunities in private sector companies and in public agencies.

“The idea will be for the participants to gain relevant career and life skills that will enable them transit seamlessly into professional, business or public sector careers, while also earning very good pay during the internship.

“These snapshots of possibility are enough to show us that we are not facing an uncertain future without any tools at our disposal.’’

The vice president said, however, that if Nigeria was to inaugurate a new age of accelerated growth, it must adopt a new strategic direction and policy orientation.

Osinbajo said that adoption of a new strategy was what the Federal Government sought to do through the National Development Plan 2021-2025 which was recently approved by the Federal Executive Council.

“ In terms of strategic direction, the cornerstone of our strategy is boosting productivity by focusing on value addition as the guiding principle for all sectors, especially agriculture, manufacturing, solid minerals, digital services, tourism, hospitality and entertainment.

“ In agriculture, for example, just as we seek to increase production of rice, we are paying equal attention to other parts of the value chain such as storage, transportation, processing and marketing,’’ he said.

Just recently, also, the vice president espoused his belief on startups and the contributions to digital economy in Africa.

Osinbajo spoke in Abuja at the 10th-anniversary dinner of AfriLabs – a network organisation, supporting innovation centres across African countries since 2011.

He said that in Nigeria, considerable progress had been made in supporting innovation by the enactment of the Nigerian Startup Act.

The vice president said that African startups were struggling as at 2015, but had leapfrogged the hurdles and got listed as unicorns.

“In 2015, African startups struggled to raise about 200 million dollars, but in 2021 we have more than six unicorns.

“In FinTech alone, we have Flutterwave, Paystack, Opay, and Interswitch, all valued at more than one billion dollars each.

“In e-commerce, we have Jumia, Ashraf Sabry’s Fawbry, an Egyptian e-payment company that allows customers to settle bills online and digitally, and is now on the Egyptian stock exchange with about 30 million customers.

“MNT-Halan, Egypt’s largest lender to the unbanked has about one million monthly active users and has disbursed $1.7billon in loans to date.

“Tala, a startup in Kenya that helps the traditionally underbanked borrow, save, and grow their money has expanded to India, the Philippines, and Mexico and has disbursed close to $3billion of credit, and has more than six million customers.

“And here in Nigeria, we have Piggyvest, a wealth management platform that at the end of 2019, had helped about one million users save about 80 million dollars.

“ And in Senegal, Wave, a mobile money provider that became Francophone Africa’s first unicorn when it received a $200million injection of funds.’’

Osinbajo said that while Africa’s fintech unicorns were payments-focused today, in the future we can expect more variety; digital lenders and insurers. Invest-tech and blockchain are also likely to feature.

“Of course, we should also expect unicorns to emerge in other sectors—companies that will help to address the continent’s key challenges in relation to healthcare, schooling, trade, and so on.”

Osinbajo called on stakeholders, especially governments across the continent to support the revolution taking place in the sector.

According to him, much of the growth of African startups has been organic–mostly operating as individual enterprises or at best as city initiatives.

He said, however, that national effort was still usually missing.

“There is now a need for positive action, proactive and intentional policies by governments to create the environment for startups and technology-based enterprises to thrive.’’

Evidentially, the efforts to encourage Nigeria’s fintech and grow more unicorns are multisectoral.

The Financial Technology Association of Nigeria (FinTechNGR) lately, in a bid to bolster fintechs, started targeting one million students and other individuals over the next five years.

The President of the association, Mr Ade Bajomo, said that the association would develop digital talents in university students, hence, its unveiling of the ”DigiStuds Programme.”

He said that the programme was aimed at developing technical expertise among the students, so as to ensure their employability in the Nigerian fintech ecosystem.

”The target is to reach a million students, individuals, over the next five years, and we have started with a handful of universities to put a process in place that is robust and repeatable and, then, we can expand on it.

”Nigeria retains her place as one of the top four fintech hubs in Africa alongside Kenya, South Africa and Egypt.

“Already, Nigerian fintech startups have raised over 321 million dollars in 47 deals as at half year 2021, compared with 307 million dollars raised in 2020.

”We are proud that Nigeria is also one of the 38 countries that have produced unicorns, such as Interswitch, Flutterwave, Jumia, Airtel Africa, OPay and, most recently, Andella.

”Innovation has not been restricted to fintech alone, as we are seeing regulators such as the CBN introduce a digital currency `eNaira’ into the economy,” he said.

With the increasing web of digital activities and burgeoning fintech sector and enabling policies, perceptive observers say, more Nigerian firms will, in no distant time, be listed as unicorns.

News Agency of Nigeria (NAN)