AFEX, one of Nigeria’s leading commodities players, has predicted that the high food prices which have been caused by inflationary pressure would continue to spike in 2022.

This is contained in a statement issued by AFEX Public Relations Analyst, Timileyin Omilana, after the company’s unveiling of its Annual Commodities Outlook report for 2022 in Lagos on Thursday.

The report predicts that the combination of rising inflationary pressure as Nigeria approaches the end of the petroleum subsidy, a possible naira devaluation in the parallel market, and increased demand pressure on commodities in the country, would increase the price of grains during the new 2021/2022 trading season.

The annual commodity outlook by AFEX also alludes to price pressures being exacerbated by the fact of 2022 is a pre-election year, which will cause some market uncertainty.

Speaking at the report launch, AFEX’s Vice President, Financial Markets, Mrs Oluwafunto Olasemo, explained that the AFEX Annual commodities outlook was a yearly outlook shared at the start of each year.

Olasemo said that it would provide some perspective on how the commodities market performed in the previous year and how commodities may perform in the new year.

“The report’s primary objective is to close a data gap in Africa’s commodity sector and to give solid market intelligence to major stakeholders in the commodities value chain,” Olasemo said.

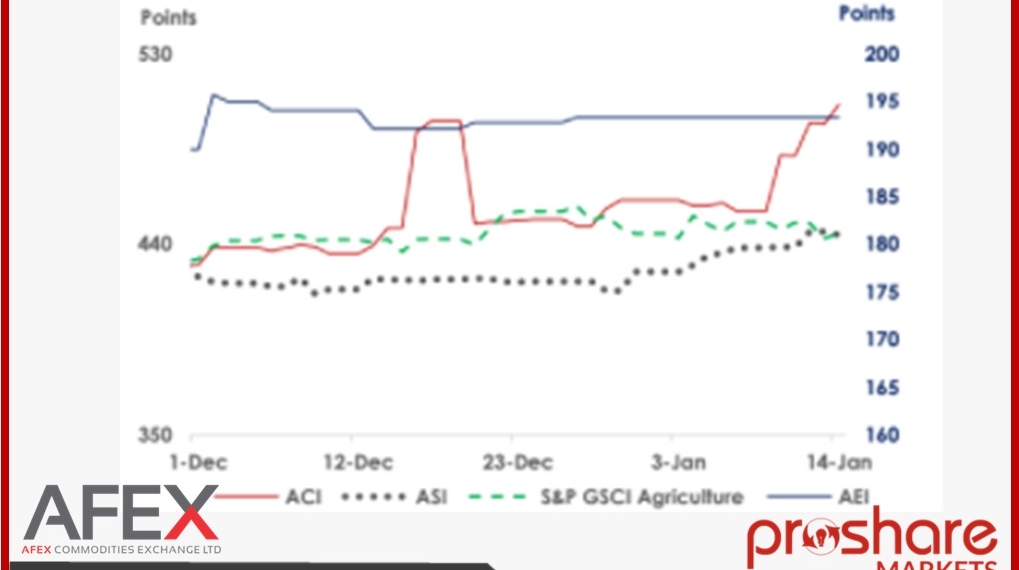

Reviewing the previous year, the report showed that after the COVID-19-induced lockdowns were lifted in 2021, the Nigerian agriculture sector expanded by an average of 1.60 per cent in the first three quarters of the year.

Although this expansion was lower than the 1.72 percent recorded in 2020, it depicted some resilience compared to other significant sectors such as industry and services.

She said that agriculture contributed an average of 25.35 per cent to Nigeria’s GDP in 2021.

Among other commodities, sesame seeds, fermented cocoa beans, cashew nuts, ginger, crude palm kernel oil, soyean, frozen shrimps and prawns drove overall agriculture exports between 2016 and 2021 and agriculture exports generated N1.79 trillion cumulatively for the country.

During the same period, Nigeria’s overall agriculture import cost was N3.78 trillion with a trade imbalance of N1.99 trillion, making Nigeria still a net food importer.

“Global food prices maintained a northward trend from July 2020 up until May 2021, reaching record highs adding to pressure on household budgets.”

“Extreme weather conditions and COVID-19 induced disruptions in supply activities, all contributed to pressured prices, income losses and exacerbated food insecurity in 2021,” the report said.

Providing an outlook for the new year, AFEX predicts that the new Omicron variant will have a negligible impact on Nigeria’s commodity supply chain.

“ However, prices across commodities started the current season at a higher minimum base price than the previous season, owing to increased demand that has surpassed supply levels.”

The report indicates that the naira’s depreciation against the US dollar and the CFA Franc has raised a demand for most staple commodities, particularly sorghum.

This will also help export commodities including cocoa, sesame, ginger, and cashew.

“We believe other upside risks to domestic commodity prices this year are insecurity, FX rate deterioration, government policies.”

“Also, the inability to close the supply shortfall by increasing harvest from dry season farming is a potential risk to pressured prices in 2022,” the report reads.”

AFEX recommended improving the productivity of Nigerian farmers to surmount the supply shortfall in most agro commodities value chains.

The commodities company also advocated for the provision of inclusive services towards farmers, which should leverage technology infrastructure that worked together to increase farmer productivity across the major grain producing regions in Nigeria.

It posited that emergence of a more productive agro-sector in Nigeria required a concerted effort from both the public and private sector.

On the company’s activities, the spokesperson explained that AFEX harnessed Africa’s commodities and talent to build shared wealth and prosperity.

“Since its inception in 2014, AFEX has developed and deployed a viable commodities exchange model for the West African market and is on track to impact one million producers; providing services in productivity and value capture and access to finance and markets.”

“By deploying an efficient market system, the company will facilitate trade with Africa worth over USD500 million in the next five years,” Omilana said.

Discussion about this post