Nigeria’s President Muhammadu Buhari has directed the deployment of technology to tax digital transactions carried out across the country.

According to secretary to the government of the federation, the president directed the Federal Inland Revenue Service (FIRS) to ensure that digital transactions are taxed.

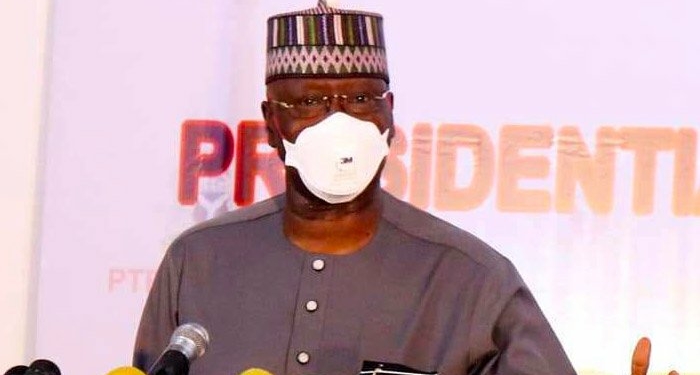

This was disclosed on Tuesday by the SGF at the 17th general assembly and 10th anniversary of the West Africa Tax Administration Forum (WATAF) in Abuja.

The SGF said FIRS had been empowered to carry out the mandate by the president and the federal executive council (FRC).

“Nigeria is putting in place measures to ensure that we keep up to date with these developments and answer the question of what to collect and how to collect it, as far as the digital economy is concerned,” he said.

“Therefore, our definition of what to collect- whether we call it income tax, Digital Service Tax or Value Added Tax, must address the issue of redefining who a taxable person or entity is, to accommodate the fact that digital transactions side-track the ordinary and traditional understanding of jurisdiction.”

Discussion about this post