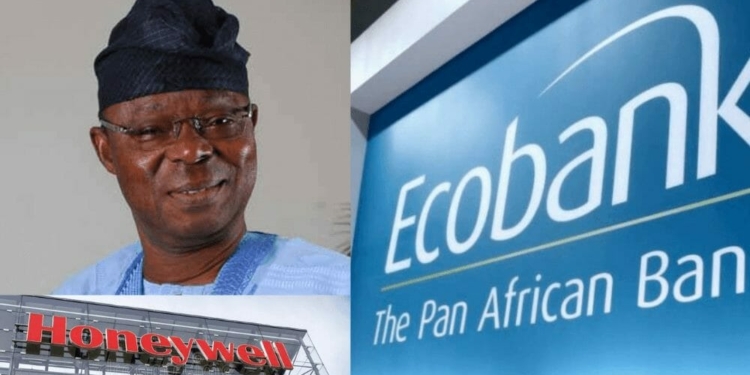

Ecobank Nigeria Limited has issued a warning to Flour Mills of Nigeria Plc over the proposed acquisition of an equity share in Honeywell Flour Mills Plc, stating that the parent company, Honeywell Group Limited, has been defaulting on its bank debts.

It was reported on Tuesday that Flour Mills of Nigeria and Honeywell Group had agreed to a transaction in which Flour Mills will buy 71.69 percent of Honeywell Group’s share in its listed subsidiary.

However, a letter obtained by journalists, written by attorneys to Ecobank, Kunle Ogunba and Associates, and sent to the Managing Director of Flour Mills of Nigeria, warned the public and corporate groups about the situation; “danger inherent in dealing in any shares of the company.”

Honeywell Flour Mills received multiple credit facilities from Ecobank, including working capital disbursements.

The bank claimed it was forced to start winding up proceedings against Honeywell Group Limited at the Federal High Court in Lagos in suit no: FHC/L/CP/1571/2015 owing to the company’s inability to liquidate the lending facilities.

It said, “However, while the said action was dismissed at the Federal High Court and the Court of Appeal, it is pertinent to state that an appeal with appeal no: SC/700/2019 has been filed challenging the said decision at the Supreme Court (Notice of Appeal is herein enclosed and marked as Annexure C).

“Hence, the effect of the above is that there is currently a winding-up action/proceeding pending against the said Honeywell Group Limited.”

The bank quoted a provision of Section 577 of the Companies and Allied Matters Act 2020 as saying, “Where a company is being wound up by the court, any attachment, sequestration, distress or execution put in force against the estate or effects of the company after the commencement of the winding-up is void…”

This, according to Ecobank, restricts Honeywell Group from proceeding with the sale of Honeywell Flour Mills to Flour Mills of Nigeria.

It added, “Consequently, we hereby demand that Flour Mills of Nigeria Plc, in its best corporate interest, immediately cease and desist from consummating the subject transaction, which aims to divest the assets of a company being wound up (Honeywell Group Limited).

“Please be further informed that the assets of both Honeywell Group Limited and Honeywell Flour Mills Plc. are the subject of the winding-up action and thus based on the doctrine of “lis-pendens” (in addition to the provisions of CAMA supplied above) you are advised to refrain from dealing with the subject asset which forms part of the subject matter of litigation.”

Discussion about this post