Association of Securities Dealing Houses of Nigeria (ASHON) has admonished dealing member firms to review their operational models, create new products and deploy technology to upscale their operations.

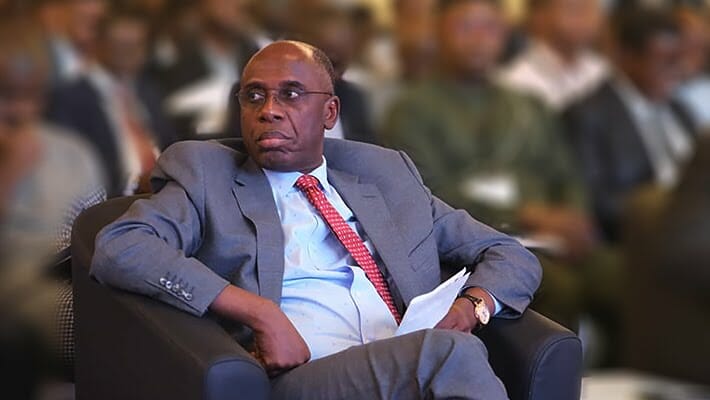

This advice was contained in a statement released on Friday by ASHON Chairman, Mr Sam Onukwue in Lagos.

Onukwue explained that the current investment climate required an innovative approach that would meet the needs of clients.

He added that investment through the Nigerian capital market had been moderated by the inclement operating environment, characterised by impacts of COVID-19 and its variants on corporate earnings.

He said the Market had also suffered from effects of misalignment of monetary and fiscal policies, high production cost and low purchasing power of consumers, currency devaluation, Forex scarcity and high inflationary pressure, among others.

According to him, every dealing member should deepen research and development and create innovative products, especially to attract the millennials in order to widen their customer base and ensure business continuity.

Onukwue harped on the deployment of modern technology to enhance the operational efficiency of ASHON members, noting that the COVID-19 pandemic had institutionalised digital transformation for every business.

He noted that millennials and generation z engage via digital channels as they do virtually everything on their smartphones.

“Our members have realised the imperative of digital transformation of our operations.

“With the impacts of COVID-19 on our business environment, demutualisation of the former Nigerian Stock Exchange to Nigerian Exchange Group (NGX), and tough operating environment, our operational models have to be reviewed.

“We must create more innovative financial products that attract millennials and Generation Z.

“They are digital natives that do almost everything on smartphones. Our business models must take this critical class of investors into consideration.

“We need to deepen our research and development base to be on top of the latest development in the global financial market.

“We appeal to our regulators to address the observed impediments to full digitalisation of our market such as the issue of identity management,” Onukwue said.

He noted that many investors were yet to recover from the meltdown of 2008, saying: “we must sustain efforts at rekindling their confidence towards bringing them fully back to the fold through investor education.

“As a trade group, ASHON shall continue to join hands with other market operators, platforms, and regulators to ensure harmonious relationships among the stakeholders in the capital market ecosystem.

“The Capital market remains a veritable platform for wealth creation in any economy.

“We shall continue to appeal to the government to leverage the market to raise medium and long term funds to fix the economy as there is a nexus between the economy and the market, hence, an enabling environment,” Onukwue said.

Discussion about this post