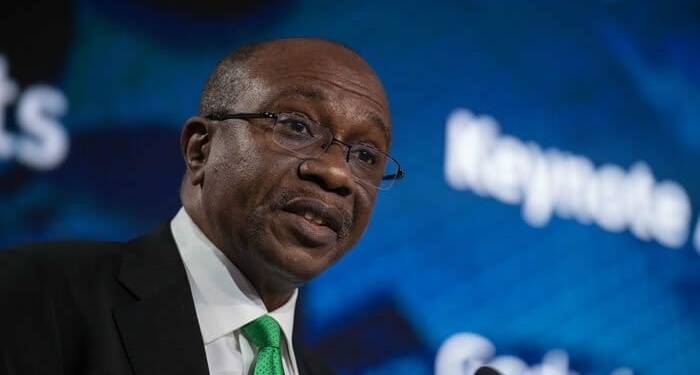

Central Bank of Nigeria (CBN) Governor Godwin Emefiele has ordered the release of N3.5 billion rebate to exporters who have brought in foreign exchange (dollars) into the economy.

The Managing Director of Fidelity Bank Mrs. Nneka Onyeali-Ikpe made this disclosure at a virtual briefing at the end of the Bankers’ Committee meeting on Thursday.

She stated: “The CBN Governor has ordered the immediate release of rebate totalling N3.5 billion incentive to our various exporters in fulfilment of his promise to raise $200 billion from non-oil export to boost the foreign exchange inflows into the county”.

Onyeali-Ikpe also disclosed “$60 million have come in according to the CBN, 150 exporters will benefit at various levels, some under the finished goods, some under the semi-finished goods that qualify for the rebate”.

According to her: “The initiative is to encourage value addition, to the export products of Nigeria specifically, to immediate and intermediate which are semi-finished products and completely finished products”.

The Central Bank of Nigeria (CBN) recently introduced the “Race to US$ 200 Billion in FX Repatriation (RT200 FX)” Programme.

It is designed to improve the inflow of stable and sustainable foreign exchange into the market.

This programme aims to raise USD200 billion in Foreign Exchange earnings over the next 3-5 years from non-oil proceeds.

The CBN will pay exporters N65 for every US1 repatriated and sold to Authorized Dealer Banks (ADBs) through the Investors & Exporters FX Window for third party use.

The CBN will pay N35 for every US$1 repatriated and sold into the I and E Window for “own” use on eligible transactions (the spread should not be more than 10 Kobo). Incentives will be paid quarterly.

Managing Director of Guaranty Trust bank Miriam Olusanya said there have been over 756.000 downloads of the eNaira App, 165,000 consumer wallets and 2,800 merchant wallets.

The advantage of the eNaira, she said, “is that it is at no cost. One of the things CBN wants to achieve is that it will remain cheaper, subsequently there will be cost but it will still be cheaper compared to other transactional channels”.

She assured users and potential users of the eNaira that “the eNaira is a digital currency that has legal backing, it is also pegged to the naira so it is not fluctuating so, it’s at the same rate as the naira”.

The CBN, she said, “has realised the fact that the future of money is digital and has proactively pioneered the Central Bank Digital Currency (CBDC) in Africa. Most countries are still in the Research and Development stage while a few are at the pilot stage”.

Other benefits of the eNaira she pointed out include that it is instant settlement, availability is almost 100 percent, no dispense errors or reconciliation like we see with other channels so the Bankers Committee will be pushing for the adoption of eNaira”.

Managing Director of Wema Bank Ademola Adebise said they “reviewed levels of adoption of e-payment platform launched last year. The objective of e-payment platform is to improve financial inclusion. It’s complimentary to other payment platforms like POS terminal, etc. The committee decided to increase the level of awareness for its huge benefits”.

Discussion about this post