One year after President Muhammadu Buhari introduced the digital currency, eNaira, through the Central Bank of Nigeria (CBN), the apex bank said the platform had already recorded 700,000 transactions worth N8 billion.

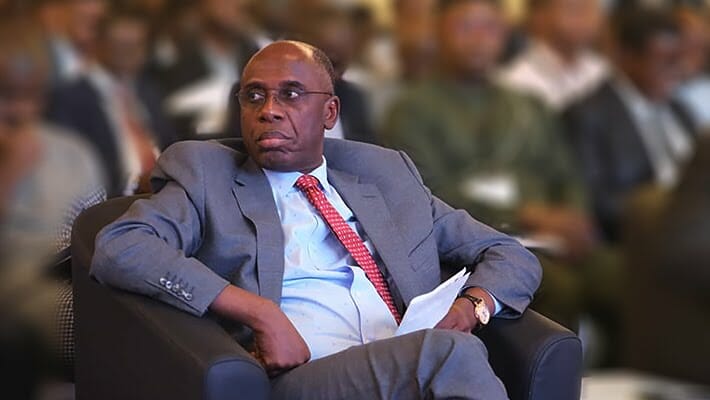

CBN Governor Godwin Emefiele announced on Wednesday in Abuja at the 28th edition of the apex bank’s annual In-house Executive Seminar, themed ‘Digitalisation of Money and Monetary Policy in Nigeria,’ according to WITHIN NIGERIA.

According to Emefiele, one of the primary goals of digital currency was to broaden Nigerians’ payment options and foster digital financial inclusion, with the potential for expediting intergovernmental and social transfers, capital flow, and remittances.

He claimed that the eNaira had been recognized globally as a success story. Aisha Ahmad, the bank governor, was represented by the Deputy Governor of Financial System Stability, CBN, and stated:

Since its launch, a total of N8 billion, consisting of over 700,000 transactions, has passed through the eNaira platform.

As part of the CBN’s effort to further integrate and broaden the usage of the eNaira, it was assigned an Unstructured Supplementary Service Data (USSD) code, enabling payments by simply dialling *997# on a mobile phone.

I am proud to announce to you today that the eNaira has been attracting accolades across the globe as a monumental success.

It topped the charts on retail CBDCs projects globally, as of April (PwC, 2022), and several central banks across the globe have been requesting our success template on the eNaira.

According to him, the story of the currency of the twenty-first century had been one of bravery, persistence, and a commitment to exploring new frontiers and possibilities. He went on to say that as part of the digitisation drive, the apex bank had taken transformative steps to embed a culture of “big data” and data analytics as tools for effective policymaking.

To this end, the CBN Data Architecture Project (CeDAP), code-named ‘Project OXYGEN’ was commissioned, with the objectives of providing a repository of a variety of data from different sources, he said.

While lauding the gains made since the launch of the eNaira, Emefiele stated that the inclusion rate of 64.0 percent has slowed the digital transformation wheel, as all citizens must be carried along to maximize the benefits of a digital economy.

While cash-based transactions have declined significantly in the last decade, it is still the dominant means of payment, amidst a large informal sector.

Nigeria boasts of one of the fastest growing FinTech ecosystems in Africa, with the industry projected to grow by 12 per cent annually.

But the technological space is still maturing, with limited market size, funding and venture capitalists, access to baseline technologies, and skills, as common features, he said.

Discussion about this post