House of Representatives has stated that it will soon promulgate a law allowing digital currencies in Nigeria.

This is despite President Muhammadu Buhari’s government continuous ban oncryptocurrency transactions.

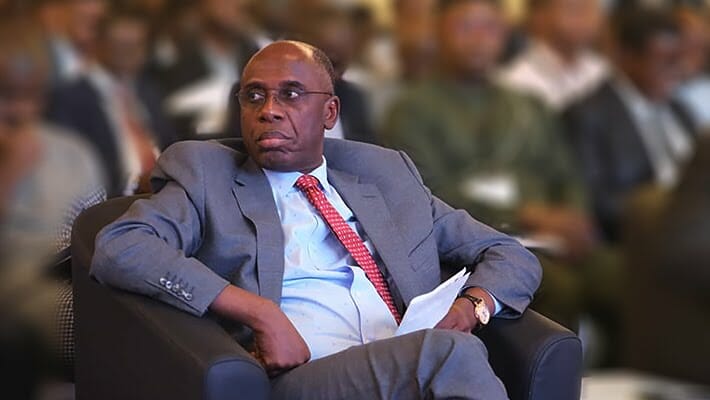

The Chairman of the House of Representatives Committee on Capital Markets and Institutions, Babangida Ibrahim, made this known in an interview with Punch Newspaper on Saturday.

He said that the Investments and Securities Act, 2007 (Amendment) Bill, when passed and signed into law, will allow the Securities and Exchange Commission to recognise cryptocurrency and other digital funds as capital for investment.

“We need an efficient and vibrant capital market in Nigeria. For us to do that, we have to be up to date global practices. In recent time, there are a lot of changes within the capital market, especially with the introduction of digital currencies, commodity exchanges and so many other things that are essential, that need to be captured in the new Act,” Ibrahim said.

The house committee chairman underscored the need to further regulate and change the legislation to accommodate cryptocurrencies, explaining that cryptocurrency regulation was not within the purview of the Central Bank of Nigeria because they are not operated with local accounts.

“All these are some of the issues that we have considered we have to regulate them. It is not that they are illegal but we don’t have regulation for them. So, these are some of the reasons why we need to review the Act and put some regulations for most of the activities – derivatives, commodity exchanges, digital currencies and so many other things,” he said.

Mr Ibrahim submitted reports on proposals attempting to overhaul the capital market on Wednesday.

One of the bills was named ‘A Bill for an Act to Repeal the Chartered Institute of Stockbrokers Act, Cap. C9, Laws of the Federation of Nigeria, 2004, and Provide for the Establishment of the Chartered Institute of Securities and Investments; and for Related Matters.’

In February 2021, the apex bank banned cryptocurrency transactions and the facilitation of payments for cryptocurrency exchanges.

The CBN further instructed all banks and other financial institutions to find and shut the accounts of anyone or anything running cryptocurrency exchanges or conducting cryptocurrency transactions.

However, in January, a bill seeking to repeal the Investment and Securities Act 2007, and to enact the Investments and Securities Act, 2021 passed its second reading at the House of Representatives .

Discussion about this post