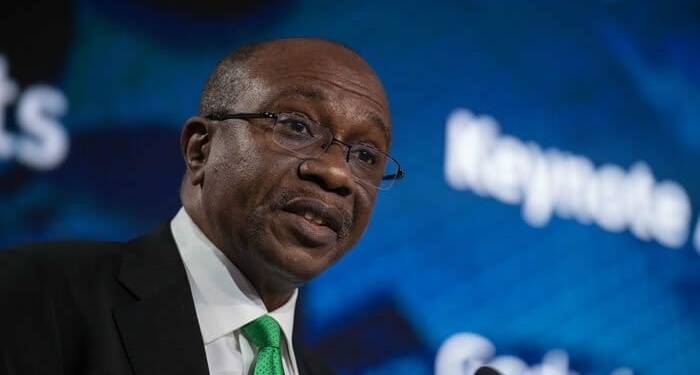

The Governor of Central Bank of Nigeria CBN, Godwin Emefiele, has explained why Point of Sale (PoS) agents are needed in the cashless policy of the apex bank.

Emefiele said the POS agents are needed because it was important to ensure that the people at the hinterlands where there may not be financial institutions are given access to financial services.

The CBN governor said the quickest financial service would be the POS at the rural communities.

The deputy governor, the Financial System Stability, Aisha Ahmed, who represented Emefiele stated these on Thursday when she appeared before the House of Representatives to brief the lawmakers on the recent monetary policies of the bank especially the cash withdrawal limit.

According to him, there were 6,500 bank locations, 900,000 POS terminals, 14,000 Automatic Teller Machines, ATMs, across the country, and 1.4 million agents nationwide.

He said every local government in Nigeria has an agent represented, adding that there were N6 trillion in POS transactions as against N48 billion in 2012 when the policy was started.

“Today, we have a very robust payment system that includes bank branches, branches of micro-finance banks, POS machines, ATM machines, agent banking, E-Naira, and many other options. To be specific, between the bank and the micro-finance banks, we have 6,500 locations, 900,000 POS terminals, 14,000 ATMs across the country, and 1.4 million agents nationwide and every single local government in Nigeria has agent represented. We also have a proliferation of electronic transactions. Just by way of quick example, in 2012, we had N48 billion in POS transactions. Today, we have N6 trillion in POS transactions.

“Going to the cash withdrawal limit that was issued in response to the feedback from Nigerians in response to the comments made by this revered chamber, we took those feedbacks on board. CBN mentioned that we will be flexible in the implementation of this policy in response to the stakeholders’ sentiments. We have since reviewed the limit significantly from N100,000 that we had per week to N500,000 per week for individuals; from N500,000 per week for corporate to N5 million per week for corporate.

“We have also amended the processing from 5 and 10 percent downward to 3 and 5 percent. We have clarified the strategic importance of agents as important participants in the financial system because they play a key role in certain underserved segments in the rural areas and in certain markets areas and they as well would be covered by this newly revised rule.

“I have seen some misconceptions about the fees that we are charging the fees on the entire amount that wants to be withdrawn. No. The fees are to be charged on any withdrawal above the limit. For example, if you are withdrawing N550,000, the fee will be on the N50,000. We also looked at transactions for agents.

“So, transactions by Nigerians that go to the agent’s location and transactions by the agents themselves, the average cash transactions of agents is N2,184,000 which is clearly within the current limit. The average transaction per individual that walks up to an agent is about N18,000.

“What the policy is trying to do is to encourage more people to come into the formal payment system because of the numerous benefits that accrue. It means opening up our rural areas, the underserved areas to economic opportunity, to payment opportunities, and connecting them to the formal system.

“During the COVID-19 period, we saw the negative impact of physical cash. No one could go anywhere. We couldn’t go to the banks. People couldn’t leave their homes. It was the electronic banking system that protected and served those below the poverty lines that had their livelihood at risk”, Emefiele said.

Discussion about this post