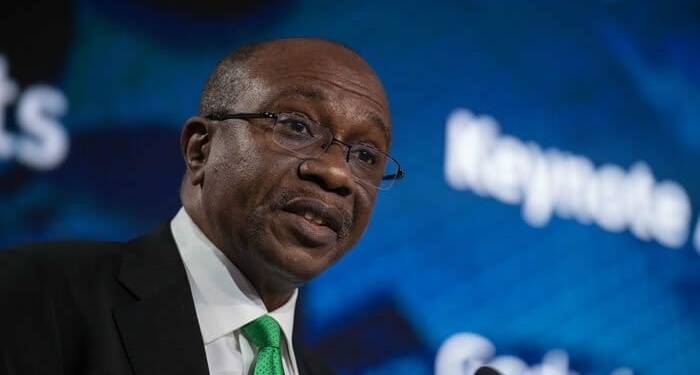

The governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has hinted that Nigerians will have to adapt to the new cashless policy regime.

This he stated on Tuesday at the conclusion of the Monetary Policy Committee (MPC) meeting in Abuja.

While apologizing for what he called isolated problems with the various e-payment platforms, the CBN governor insisted that the issues were being addressed.

According to Emefiele, the glitches will soon be a thing of the past.

Nigerian Banks Are Safe

Responding to questions about how the recent collapse of several banks in the United States of America may impact banks in Nigeria, Emefiele said Nigerian banks are safe and sound as they have zero exposure to the failed banks in the USA.

According to Emefiele;

no depositor has lost one kobo since 2008 from bank crisis because of the prudential guidelines put in place to protect depositors fund.

He also warned bank shareholders to mindful of the fact that “banking licence is a privilege not a right it can be withdrawn if shareholders misbehave.

“We would rather dispense with the shareholders than put depositors’ money at risk,” the CBN governor stated.

As per earlier reports, the MPC meeting agreed to increase Monetary Policy Rate to 18 percent from the previous 17.5 percent adopted in January.

Discussion about this post