- CBN had floated the Naira

- Naira had continued to fluctuate since the floating

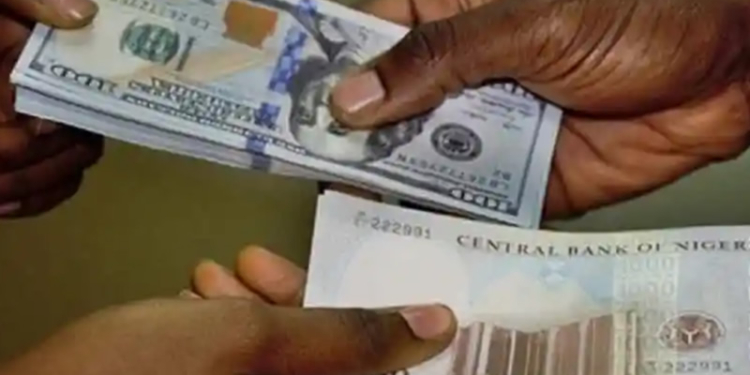

The Naira dropped further in the parallel market on Thursday, trading at N945/$1 in Abuja, compared with the N925 to a dollar it went for the previous day.

However, on the official market known as the Investors and Exporters (I&E) window, the Naira closed at N781/$1 compared with its opening rate of N782/$1.

Consequently, on Thursday, the International Monetary Fund said Nigeria’s loose fiscal and monetary policies created excess liquidity.

The Washington-based fund explained the inadequate fiscal policies as the reason the Naira could not stabilize against the dollar two months after the Central Bank of Nigeria liberalized the forex market.

WITHIN NIGERIA recalls that on July 14, CBN floated the Naira; however, the country’s currency had continued to fluctuate since the introduction.

Folashodun Shonubi, the Acting CBN governor, said it had started addressing pent-up demand for forex.

Meanwhile, the Acting Governor of the Central Bank of Nigeria (CBN), Folashodun Shonubi, announced on Thursday that the Nigerian Naira is significantly undervalued, according to economic modelling using purchasing power parity.

This revelation came during a lecture titled ‘Diaspora Remittances and Nigeria Economic Development’ held at the National Institute of Security Studies (NISS) in Abuja.

“If you were to conduct an economic modeling of Nigeria using purchasing power parity, you would discover that the Naira is currently significantly undervalued,” Shonubi stated.

He emphasized the need for stringent measures to control illegal remittances and direct them into appropriate channels to maximize economic growth.

Shonubi also said that a panel would be set up to conduct surprise visits to banks suspected of illegally selling dollars.

“We need to name and shame commercial banks involved in such malpractices,” he said.

The acting governor further highlighted the challenges with the current remittance system, where the cost of sending money to sub-Saharan Africa from the diaspora stands at around 8-9% per $100, the highest in the world.

Interestingly, he explained, Nigeria received approximately $16.7 billion in remittances, but the bulk of this money remains outside the formal market.

“We are striving to encourage individuals to bring money into the formal sector instead of relying on informal channels, as it has become challenging to manage,” Shonubi added.