- Government inherited high unemployment, falling per capita, and inflation at 24%, focusing on stable economy without heavy borrowing

- Emphasis on creating favorable macroeconomic environment to attract local, foreign investment, improve production, increase revenues without reliance on borrowing

The Federal Government stated on Monday that it inherited a bad economy with an unacceptably high unemployment rate.

On May 29, 2023, President Bola Tinubu took over from ex-President Muhammadu Buhari and implemented some economic policies.

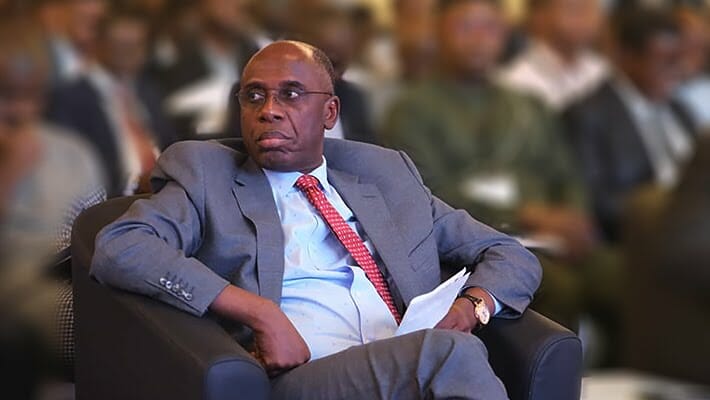

At the conclusion of the inaugural Federal Executive Council (FEC) meeting in Abuja, Minister of Finance Wale Edun assured Nigerians that the Tinubu administration would not rely on borrowing to fix the country.

When asked to describe the type of economy the government encountered on the ground, he stated, “Per capita had fallen steadily, inflation is at 24%, unemployment is high, and you know they’re rebasing the way it’s calculated.”

Either way, it is high and youth unemployment is even unacceptably high, these are the key metrics that we have met. We met a bad economy and the promise of Mr. President is to make it better.

Speaking further, he said the Federal Government was not in a position to borrow money at “this time”, adding the emphasis is on how to create a macroeconomic environment where both local and foreign investors would invest and increase production.

Clearly, the federal government is not in a position to borrow at this time. Rather, the emphasis has to be on creating a stable, macroeconomic environment. Stable inflation, stable exchange rate, an environment within which people can come and invest and thereby increase production and further grow the economy. Improve and create jobs and reduce poverty,” he said.

So, the aim of all reforms at this time is to focus on what we call equity to focus on investment to attract investment by Nigerians. Investment by foreign direct investors and even investment by portfolio investors that want to invest in the financial aspects of the Nigerian economy, such as the stock market, such as the bond market.

So that is the plan. That is the expectation and it is that there will not be a reliance on borrowing. Rather, as revenues increase, as the benefit of removing fuel subsidy and the subsidy on the exchange rate, those mean more money for the government at all levels.

Because, of course, through oil revenue, the federation earns dollars and if those dollars are feeding through, at let’s say, 700/750 or so naira to one dollar as opposed to 460 where it was before; clearly, that is repairing the finances of government are federal state and local government levels.

Discussion about this post