- The Presidential Fiscal Policy and Tax Reform Committee proposes suspending levies on petty traders to ease the burden on small businesses

- The committee aims to simplify the complex tax system and has received support from governors while facing resistance from vested interests

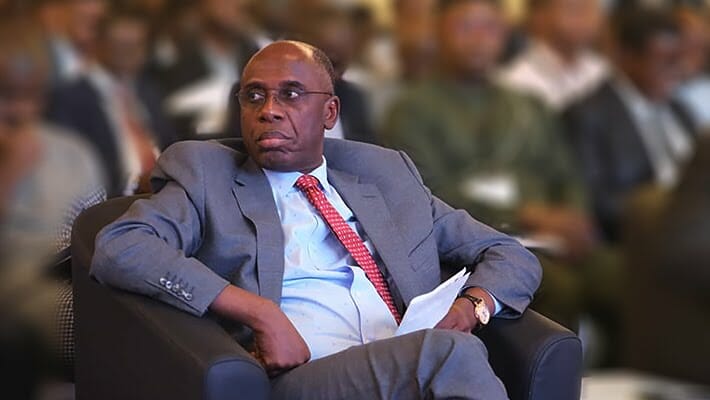

The Presidential Fiscal Policy and Tax Reform Committee has recommended the suspension of levies imposed on petty traders. Taiwo Oyedele, the committee’s chairman, made this announcement during an interview on Channels TV, emphasizing that the goal is to alleviate the burden on small businesses.

Oyedele further highlighted that the government generates 98% of its revenue from fewer than 10 taxes. He stressed the unnecessary complexity of having numerous taxes that create difficulties for the populace and potentially fund criminal activities.

He stated, “What we are trying to do is to say that while we may not be able to resolve these issues in 30 or even 60 days, we presented this recommendation to the National Economic Council (NEC) at their last meeting, and the governors were quite excited about it. One of the recommendations is that we suspend certain taxes, such as bicycle taxes and wheelbarrow taxes.”

Oyedele explained that the decision to suspend these taxes was met with enthusiasm, and he urged the governors to support this move. He pointed out that 98% of the combined revenue for all levels of government is derived from fewer than 10 taxes, indicating that there is no need for the excessive complexity of 200 taxes, which can create problems for citizens and potentially fund criminal activities.

In response to questions about potential resistance to the committee’s recommendations, Oyedele acknowledged that some influential individuals were already attempting to obstruct their work. He emphasized that when attempting to reset established norms, there will always be resistance from those who benefit from the existing system. Nevertheless, he expressed confidence that the collective will of those striving for reform would prevail in the end.

Discussion about this post