- The DMO attributed Nigeria’s increased public debt to factors including exchange rate fluctuations and securitisation of Ways and Means Advances

- Director-General Patience Oniha clarified that the debt surge also stemmed from new borrowings and changes in interest rates

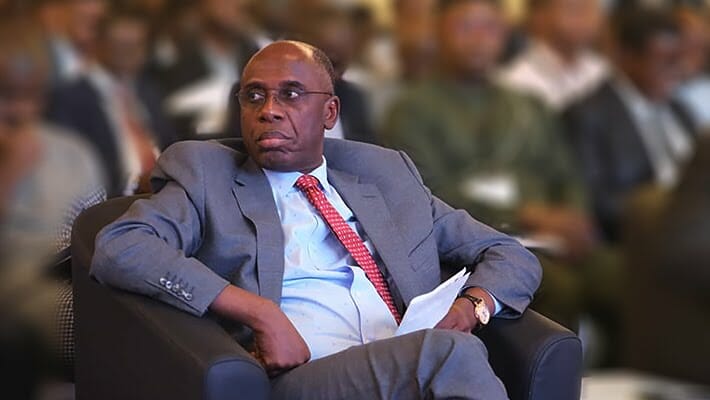

The Debt Management Office (DMO) has explained the significant increase in Nigeria’s public debt stock, attributing the rise from N97.34 trillion in December 2023 to N121.67 trillion in March 2024 to various factors, including fluctuations in the exchange rate. The DMO’s director-general, Patience Oniha, clarified these details during an interview with the News Agency of Nigeria (NAN) in Abuja on Tuesday.

Oniha addressed misconceptions surrounding the updated total debt profile, highlighting that a major contributor to the N24.33 trillion increase was the securitisation of N4.90 trillion from the N7.3 trillion Ways and Means Advances approved by the National Assembly. She emphasized that this securitisation, combined with changes in exchange rates, significantly influenced the surge in debt.

Additionally, Oniha noted that other factors, such as the interest rate environment and new borrowing, amounting to N2.81 trillion as part of the N6.06 trillion provisioned in the 2024 budget, contributed to the overall debt increase. She underscored that the debt stock encompasses domestic and external debts of Nigeria’s 36 states and the Federal Capital Territory (FCT).

“The total public debt as of March 31 showed that the total public debt in Naira terms stood at N121.67 trillion compared to N97.34 trillion as of December 31, 2023,” Oniha stated.

Further detailing the breakdown between external and domestic debt, Oniha explained that economic reforms, particularly affecting the dollar/naira exchange rate and interest rates, substantially impacted the debt stock and debt service obligations.

She clarified that the increase of N24.33 trillion between the fourth quarter of 2023 and the first quarter of 2024 did not solely represent new borrowing. She pointed out that while the total external debt stock remained relatively stable at $42.50 billion and $42.12 billion, respectively, during these periods, the Naira values differed significantly due to exchange rate fluctuations.

“In dollar terms, the total debt stock declined in the first quarter of 2024 to $91.46 billion, reflecting the impact of exchange rate movements,” Ms Oniha explained.

She emphasized the importance of fiscal discipline by the Federal Government and highlighted ongoing measures to attract foreign exchange inflows, increase external reserves, and stabilize the Naira exchange rate.

Overall, Oniha suggested that, apart from the effects of currency exchange, Nigeria’s debt levels were moderate and manageable within reasonable limits, urging continued efforts to enhance fiscal sustainability and economic stability.

Discussion about this post