- President Bola Tinubu requested the national assembly to pass four tax reform bills on October 13, 2024.

- The proposed laws include the Nigeria Tax Bill, Tax Administration Bill, and Joint Revenue Board Establishment Bill.

Governor Abdullahi Sule of Nasarawa state has said that passing tax bills will bring in more investments and boost Nigeria’s economy.

Sule’s statement follows the Nigeria Governors’ Forum’s (NGF) endorsement of the proposed tax legislation, currently under consideration at the national assembly.

On Thursday, the NGF proposed a fair sharing formula for Value-Added Tax (VAT) after meeting with the Presidential Tax Reform Committee.

The governors recommended removing terminal clauses for TETFUND, NASENI, and NITDA when sharing development levies.

They also supported continuing the legislative process to eventually pass the tax reform bills.

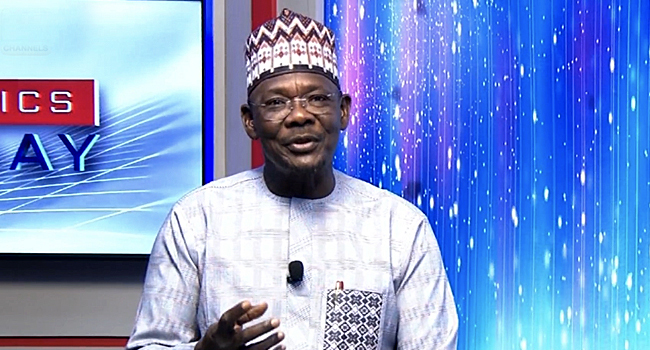

Speaking on Channels Television’s Politics Today, Sule said the tax reform bills would benefit Nigerians if passed.

“The bigger picture at the end of the day is to get it passed for the interests of Nigeria in order to attract more investment into Nigeria. Part of the reform is actually the attraction of additional investments into Nigeria,” Sule said.

“Eliminating multiple taxations, reviewing stamp duties, and addressing royalties will encourage companies to stay in Nigeria.”

Sule noted that Nasarawa is attracting investments in mining and agriculture, making it an ideal business destination.

President Bola Tinubu requested the national assembly to pass four tax reform bills on October 13, 2024.

The proposed laws include the Nigeria Tax Bill, Tax Administration Bill, and Joint Revenue Board Establishment Bill.

However, northern governors urged the national assembly to reject legislation harming their region’s interests.

The governor called for fair implementation of national policies to prevent marginalization.

The presidency assured northern governors that the proposed laws aimed to improve Nigerians’ lives and optimize tax frameworks.