-

Nigeria’s Consumer Price Index declined to 24.4% in January, but food inflation remains high at 26.08%, raising concerns about affordability

-

Financial experts warn that despite lower inflation rates, rising commodity prices could push more Nigerians into poverty if not addressed

Despite Nigeria’s Consumer Price Index (CPI) declining to 24.4% in January, the soaring cost of food remains a significant concern.

The National Bureau of Statistics (NBS) announced that the CPI, which tracks price changes in goods and services, has shifted its reference period from 2009 to 2024 to align with international standards.

Although food inflation dropped to 26.08% from December’s 39.84%, financial experts warn that failing to curb rising commodity prices could push more Nigerians into poverty.

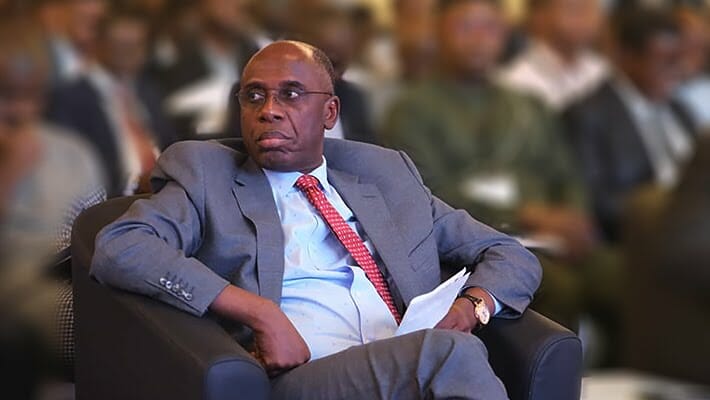

Muda Yusuf, Director/CEO of the Centre for The Promotion of Private Enterprise (CPPE), told Daily Trust that lowering inflation does not equate to lower prices.

He explained that lower inflation means a slower rate of price increases, not an actual price decrease.

He cautioned against excessive celebration of the inflation drop, emphasizing that high prices continue to impact business operations, living costs, and poverty levels.

Households and businesses still grapple with high energy costs, a weak naira, high interest rates, expensive imports, rising transportation costs, and insecurity.

He urged the government to refine its strategies to tackle these economic challenges.

Yusuf stressed that Nigerians truly need a drop in overall price levels from the extreme highs of 2024 to more manageable levels in 2025, a process known as disinflation.

“The positive news is that we are starting to see reductions in the prices of petrol, diesel, some food items, and pharmaceuticals. It is hoped that this downward trend will continue throughout the year,” he added.

Discussion about this post