-

Nigerian Navy Microfinance Bank expanded its assets from ₦20 million to ₦20 billion in a decade, fostering inclusion

-

Leadership emphasized innovation, governance, and partnerships to enhance financial services for naval personnel and the wider Nigerian community

The Nigerian Navy Microfinance Bank (NNMF Bank) has achieved significant financial growth, expanding its capital base from N20 million to N20 billion in assets within a decade.

Licensed by the Central Bank of Nigeria and managed by Navy Holdings, a private firm of the maritime force, the bank provides financial solutions to naval personnel, their families, and other Nigerians.

Speaking at the bank’s 10th-anniversary celebration, the Director of Supervision, Olatunji Ayoade, described the milestone as a testament to the institution’s dedication to financial inclusion and economic empowerment.

“From a humble beginning with a seed capital of N20 million, we have expanded our services, improved financial inclusion, and helped thousands achieve economic stability,” Ayoade stated.

“Our total assets now exceed N19 billion. In 2024 alone, the bank doubled its balance sheet. This is more than an anniversary—it reflects our shared vision, commitment, and the unwavering trust our founders and customers placed in us.”

Ayoade highlighted that the bank has played a crucial role in providing secure banking solutions, supporting small businesses, and promoting financial empowerment for both naval personnel and the public.

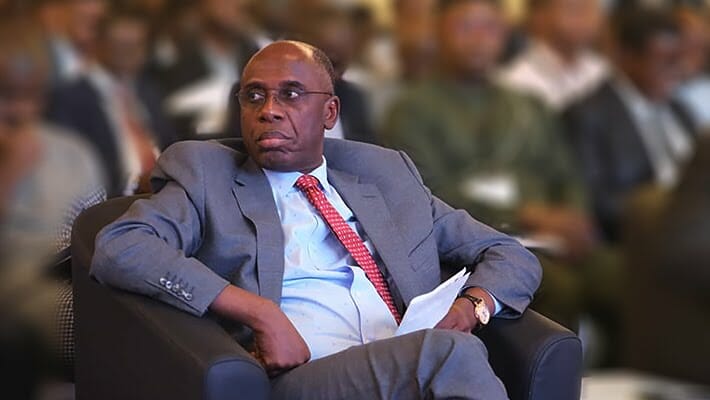

The Group Managing Director and Chief Executive Officer of Navy Holdings Limited, Rear Admiral Zakariya Muhammad, commended the bank’s leadership and staff for their dedication to its success.

He encouraged them to embrace innovation, strengthen corporate governance, and expand their outreach to drive financial inclusion and create more economic opportunities.

“The achievements of NNMF Bank over the past ten years are commendable. The bank has empowered individuals financially, supported small businesses, facilitated wealth creation, and ensured secure and reliable banking for our servicemen and women,” Muhammad said.

He urged the institution to continue fostering strategic partnerships, enhancing corporate governance, and adopting innovative solutions to further expand financial inclusion.

Discussion about this post