- He called for strict measures to prosecute offenders, stressing that law enforcement must curb illegal naira trading and financial crimes.

- Ribadu criticised unregulated cash transportation, stating that large sums are frequently moved via commercial flights, private jets, boats, and other means.

The Central Bank of Nigeria (CBN) has expressed alarm over the increasing occurrence of unauthorised financial dealings involving banknotes across different parts of the country.

CBN Governor, Olayemi Cardoso, made this known during the bank’s security workshop held in Abuja on Thursday, where key security and law enforcement officials were present.

During his address, Cardoso revealed that undercover shopping investigations conducted in major cities such as Abuja, Asaba, Awka, Benin, Ilorin, Kano, and Ibadan exposed concerning cases of naira misuse.

“A critical concern that arises from these transactions is an illegal act and a premium charged on banknotes ranging from 20 percent to 40 percent per transaction,” he said.

“The gravity of this situation is further exposed by a recent exercise where banknotes amounting to N2.3 million were acquired with a total payment, including premiums, of N3.2 million.”

Cardoso cautioned that this illegal practice distorts the actual worth of the naira and diminishes public trust in the country’s financial framework.

He further pointed out that the misuse of naira is frequently showcased on social media, where people are seen throwing, mishandling, and even trampling on banknotes during social gatherings.

“When we talk about credibility and trust, we don’t build it this way,” Cardoso said.

“The blatant disregard for our nation’s legal tender not only weakens the value of the Naira but also erodes respect for our national identity. If we disrespect it this way and expect a strong naira, we are deceiving ourselves.”

The CBN governor also emphasised the necessity of implementing firm measures to deter offenders, urging security agencies to identify and prosecute those involved in illegal currency trading.

“By sending a strong message to the public that these actions will not be tolerated, we can foster a sense of responsibility and respect towards our currency,” he added.

Cardoso went on to highlight broader security concerns affecting CBN operations, such as inadequate armed security personnel in high-risk locations and delays in obtaining security clearances for cash movements.

He also mentioned disruptions in routine approval processes, inefficiencies in handling cash-in-transit operations, and the unlawful arrest and detention of individuals involved in financial transactions.

Cardoso stressed that tackling these challenges requires a well-structured approach, improved security frameworks, and stronger collaboration between financial regulators and law enforcement agencies.

“We all have a tremendous responsibility to protect what has been accomplished,” he said.

“This is not just a Central Bank problem. We all have to work together and take pride in restoring confidence in the financial system. The Naira is more than just a currency; it is a symbol of our national identity, and its strength is crucial for the economy.”

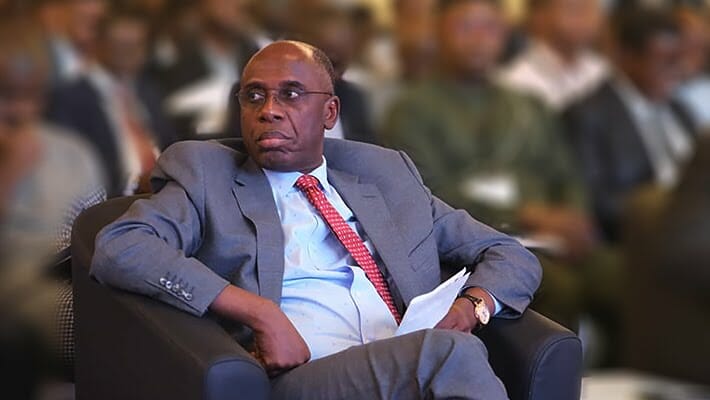

In response, National Security Adviser, Nuhu Ribadu, called for stricter enforcement measures against those engaging in naira abuse and financial misconduct.

“From time to time, when law enforcement acts, I think they should do more. Bringing people to justice, no matter how bitter, is necessary,” Ribadu said.

“Impunity is the mother of all the problems we have. Nobody is punished for bad behaviour, and they don’t even see it as a bad thing until they are held accountable.”

He also raised concerns about the unregulated movement of cash within the country, particularly through various transportation channels.

“In Nigeria today, if you board a commercial aircraft, half of the seats are occupied by money—not to mention private aircraft, boats, and other means of transport. This lack of control creates an avenue for illegal activities to thrive,” he said.

Ribadu urged financial institutions to enhance their internal security systems and called on law enforcement agencies to proactively combat emerging financial threats.

Discussion about this post