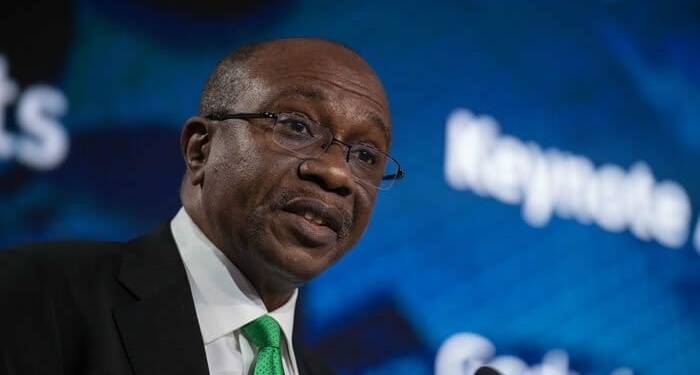

The Central Bank of Nigeria has stated that borrowers who divert funds provided under the Agricultural Credit Guarantee Scheme may earn a five-year jail term.

This was contained in a report released on Thursday by the CBN and titled ‘Guidelines for the Agricultural Credit Guarantee Scheme’.

“Banks should remind prospective borrowers under the scheme that it is an offence for which one may be imprisoned for five years to apply the loan for purposes other than those for which they are given,” it said.

It said the maximum liability of the fund in respect of any guarantee given under the scheme would be fixed from time to time by the ACGSF board.

According to the CBN, the single obligor limit for non-tangible collateral is N100,000 while the obligor limit for individual, group/co-operative or a corporate society is N50m for secured loans.

It said the liability of the fund would be 75 per cent of the amount in default, net of any amount realised by the bank from the security it got from the borrower, subject, in the case of a loan to an individual, a co-operative society or a corporate body, to a maximum of N50m.

The central bank said the revised regulatory and supervisory guidelines of microfinance banks must be strictly adhered to as “it stipulates that the maximum principal amount for a microloan shall not exceed N500,000 or one per cent of the shareholders’ fund unimpaired by losses and or as may be reviewed from time to time by the CBN”.

Discussion about this post