The origin of commercialized banking in Nigeria dates back to when the country was once a British colony. Before the amalgamation of the country, let alone its independence, the country had always run a financial institution, African Banking Corporation, which later handed its operations in Lagos to British Bank of West Africa (now known as First Bank of Nigeria). Other commercial banks followed suit including the newly acquired union bank of Nigeria PLC. Between 1929 and 1960 nothing less than 26 such banks were formed. They are namely National Bank of Nigeria, Wema Bank {formerly Agbonmagbe bank}, African continental Bank of the North.

While some very old banks have ceased to exist due to civil war, debt, government policies, mergers, acquisition, etc, some are still existing and waxing strong. More so, despite the rise of very young and techie new generation banks that are tailored towards the young generation, some of these old banks are still pulling their weights, serving their loyal customers and recording huge profit.

Earlier in June, one of Nigeria’s oldest banks, Union Bank, was acquired by Titan Trust Bank which commenced operations in October 2019, after the latter completed acquisition of 89.39% majority stake in Union Bank. This acquisition of the 104-year-old Union bank by a bank that is merely 2 years old, is one of the most remarkable acquisitions in the Nigerian Banking space.

With Union bank finally acquired, which are the oldest banks in Nigeria still existing?

First Bank Nigeria Plc

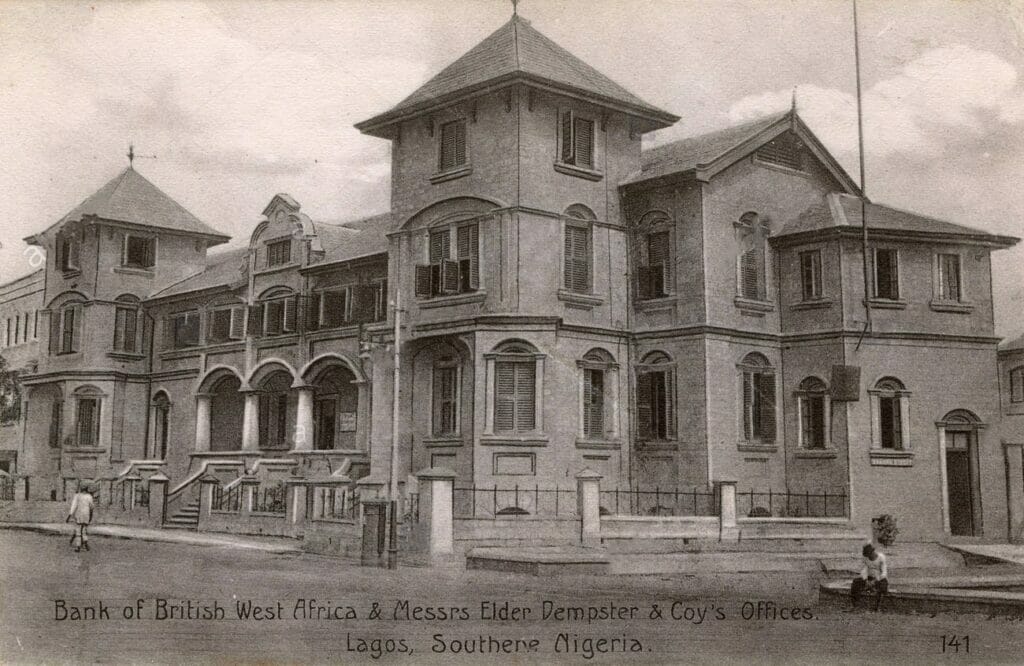

Nigeria oldest bank. Firstbank of Nigeria (“First Bank”), built up in 1894, is the first bank in Nigeria and the premier Bank in West Africa.

The Bank was founded by Sir Alfred Lewis Jones, a shipping magnate from Liverpool, England who originally had a monopoly on importing silver currency into West Africa. With its head office originally in Liverpool, the Bank commenced business on a modest scale in Lagos, Nigeria under the name, Bank of British West Africa (BBWA).

The Bank of Nigeria (formerly known as Anglo-African Bank) was established in 1899 by the Royal Niger Company and became its first rival in 1912. The name of the bank was changed from Bank of British West Africa (BBWA) to Bank of West Africa in 1957. (BWA). Following its merger with Standard Bank of the United Kingdom in 1966, the bank changed its name to Standard Bank of West Africa Limited, and in 1969 it was established locally as Standard Bank of Nigeria Limited in accordance with the Companies Decree of 1968.

Changes in the name of the Bank also occurred in 1979 and 1991 to First Bank of Nigeria Limited and First Bank of Nigeria Plc, respectively. In 2012, the Bank changed its name again to FirstBank of Nigeria Limited as part of a restructuring resulting in FBN Holdings Plc (“FBN Holdings”), having detached its commercial business from other businesses in the FirstBank Group, in compliance with the new regulation by the Central Bank of Nigeria (CBN).

Wema Bank Plc

Wema Bank is the longest surviving indigenous bank in Nigeria. The bank was established on May 2, 1945, as a private limited liability company, under the old name of Agbonmagbe Bank Limited by the Late Chief Mathew Adekoya Okupe.

He set up the first branches of the bank in Ebute-metta, Sagamu, Abeokuta and Ijebu-Igbo. The bank remained his until it was taken over by Western Nigeria Marketing Board and later renamed Wema Bank Limited in 1969. It was granted a commercial banking license and commenced banking activities during the same year. Wema Bank converted to a public limited liability company in 1987. In 1990, the Bank was listed on the Nigerian Stock Exchange.

December 2015, Wema turned into a national bank, with a capital base of over N43.8billion having met the regulatory necessities for the National Banking license as stipulated by the Central Bank of Nigeria.

Wema Bank launched the first fully digital bank in Nigeria, ALAT By Wema, in May 2017. It is also the first digital bank in Africa. In a bid to redefine experiential banking in Nigeria, the branchless, paperless bank reduced the stress of having to walk into a branch to open an account with a seamless sign up process using a mobile phone, PC or tablet.

United Bank For Africa (UBA)

UBA is the leading sub-Saharan African bank with over 20 million customers, 20,000 employees, and 1,000 branches across 20 African countries. It began operations in Africa in 1949,as the British and French Bank Limited (BFB). UBA assumed control over the assets and liabilities of BFB and was incorporated as a limited liability company on 23 February 1961 under the Compliance Ordinance (Cap 37) 1922.

In 2005, it completed perhaps the greatest merger in the history of Nigeria’s capital markets with the business blend with Standard Trust Bank (STB) Plc.

Pursued by its pioneer Initial Public Offer in the Nigerian banking industry in 1970, UBA got listed on the Nigerian Stock Exchange. It is publicly traded under the image “UBA” and it is the first Nigerian-headquartered bank to dispatch Global Depository Receipts.

The Group Chairman of the bank is Tony Elumelu and the GMD/CEO is Kennedy Uzoka.

Sterling Bank

Sterling Bank Plc Is one of the oldest banks in Nigeria was initially incorporated in 1960 as Nigeria Acceptances Limited (NAL). The bank was licensed as Nigeria’s first merchant bank in 1969.

The bank was licensed as Nigeria’s first merchant bank in 1969. Consequent to the indigenization decree of 1972, the Bank became fully government owned and was managed in partnership with Grindlays Bank Limited, Continental International Finance Company Illinois and American Express Bank Limited between 1974 and 1992. In 1992, the Bank was partly privatized and listed as a public company on the Nigeria Stock Exchange (NSE). Eight years later, in 2000, the Federal Government sold its residual interest in the bank, effectively making it a fully privatized institution.

In January 2006, as part of the consolidation of the Nigerian banking industry, NAL Bank completed a merger with four other Nigerian Banks namely, Magnum Trust Bank, NBM Bank, Trust Bank of Africa and Indo-Nigeria Merchant Bank (INMB) and adopted the name ‘Sterling Bank’.

Heritage Bank

Heritage Bank has stood the test of time after several Central Bank’s policies such as mergers and acquisitions. The bank traces its roots to the late 1970s, when it was founded as Societe Generale Bank (Nigeria), by the late Dr. Olusola Saraki.

In January 2006, the Central Bank closed down Societe Generale on account of failure to meet new minimum capital requirements of US$155 million (NGN:25 billion) for a National Bank. Societe Generale successfully challenged the closure in court. In December 2012, the Central Bank re-issued Societe Generale’s banking license, but as a regional bank.

Having acquired the banking license, the new ownership re-branded the bank as Heritage Banking Company Limited and opened for business under the new name on 4 March 2013.[5]

In October 2014, Heritage Banking Company Ltd successfully met the requirements of the Asset Management Corporation of Nigeria (AMCON) and the Central Bank of Nigeria toward owning 100% shares in Enterprise Bank Ltd. As of September 2013, the bank’s stock is publicly owned by the following corporate entities and individuals

On 27 January 2015, AMCON officially transferred ownership of Enterprise Bank Ltd to Heritage Bank Plc.