Before becoming a POS agent, you must choose a PoS service company. These companies provide financial services to make access to cash and financial transactions in a bid to drive the Nigerian cashless economy as well as reaching the unbanked. There are many of these PoS service providers in Nigeria ranging from virtually all commercial banks, microfinance banks to fintech companies.

Below are the PoS service providers in Nigeria in terms of popularity, ease of registering and their services they render.

- First bank

- Ecobank

- Opay

- Paga

- Wema Bank

- Baxi Box

- Palmpay

- Bankly PoS

- Monie Point PoS

- Nomba PoS

First Bank

First bank is one of the pioneers of POS business in Nigeria. Their POS agents are called Firstmonie agents and can be in many streets and kiosks in Nigeria. To become a Firstmonie Agent, you need to have:

- An existing business for at least 12 months.

- A functional First Bank account for one year.

- A visible and accessible business location

- A valid means of identification (Voters’ card, National ID card, Drivers’ License, International Passport)

- BVN

- Utility bill not more than three (3) months old

- Business registration documentation for corporate bodies

How to become a First Bank POS Agent

To begin, visit the FirstMonie agent banking website and fill out the form. Then, submit your request to FirstBank by clicking on the “Send” button. Watch out for mail or messages when your application has been approved. However, to fast track your application, visit any FirstBank branch to check the status of your application. Importantly, remember to go to the bank with the required documentation.

Ecobank Xpress Point

Ecobank Xpress Points are Ecobank approved locations for their PoS business.

Requirements To Getting Ecobank POS For Your POS Business

- A desktop with an internet connection

- An Android-enabled device to enable the download of Agent App

- A feature phone for USSD transactions

- Passport photograph

- Bank Verification Number (BVN)

- Valid means of identification: National ID (NIN Card), Driver’s License, Permanent Voter’s Card (PVC) or International Passport

- Utility bill of Agent’s operating address (not more than three months)

- Two (2) current/corporate account references or duly completed Character Reference Form

Becoming An Agent

- Firstly, Visit the Ecobank Xpress Point registration portal and submit your Ecobank POS agent application.

- Choose your type of business

- Choose your device type (desktop, laptop, smartphone)

- Once your application is received, An Ecobank representative will contact you within 72 hours.

You can send an email to EngAgencySupport@ecobank.com to do a follow-up on your application.

OPay

Opay is a fast-rising Fintech company that has used its POS agency to create opportunities for many Nigerians. This licensed mobile money platform is also known as Paycom. If you want to become an Opay agent, you don’t need to make any payment. Just download the Opay app and sign up to become an agent.

You need the following requirements to register your Opay business: Bank Verification Number (BVN), Utility bill not older than three months, Valid means of identification and Passport photographs. New Opay account owners cannot apply for the Opay POS machine. You must have been a POS Agent who has accumulated a good transaction history on your OPay account.

How to become an OPay POS Agent

- Download the OPay app on the play store.

- Send an email to ng-support@opay-inc.com requesting for the OPay merchant application form.

- You can also log into the OPay app and select the Merchant icon.

- Enter your details.

- Upload all the required documents.

- Submit the application form for review within 24 hours.

- Once the request is approved, an Opay staff will contact you to come and pick up the POS device.

Opay POS charges can go as low as 0.5% per transaction (if you’re using the mini POS). However, note that the Initial charge per transaction is 0.6% and then 0.5% after upgrading to Preferred Opay Merchant status. The Opay POS is free for agents who have built a good transaction history with Opay, but they must have a caution fee of NGN20,000 available in their wallets.

Paga

Paga is a financial institution that permits individuals who desire to make an income, to become their POS agents and support their organisation. A Paga POS agent is an independent merchant that has received training from Paga to provide their customers with POS services. To become a Paga POS agent, kindly email service@mypaga.com or Log on to www.paga.com, select Agent and click on Become an Agent to get started.

Once you are done, one of Paga’s field representatives will contact you for further instructions on the onboarding process. To sign-up to become an agent is free, but if you want a POS terminal, you must pay N30,000.

As a Paga agent, you will receive a commission for every transaction you perform. In addition, bonuses and other incentives are rolled out at intervals. The more transactions you complete, the more money you make.

On transaction charges, Paga charges N5.5 on every N1000 a customer withdraws and N30 to transfer any amount on the POS or the app.

Wema Bank

You don’t need to pay to become a Wema Bank POS agent. Just have an existing business with a physical location and meet the general requirements for applying to become an agent. The standard merchant service charge is 0.5% per transaction, capped at N1000. To begin, these requirements essential

- A verifiable existing business on the ground.

- A functional Wema bank account.

- A valid means of identification such as a national identity card, international passport, driver’s license, and voter’s card.

- A minimum start-up capital is also required.

- A functional internet-enabled mobile phone with data.

How To Become A POS Agent For Wema Bank

Physical

Visit the nearest Wema Bank branch having all necessary documents.

Fill out the agent registration form.

You will be contacted if your application is approved.

Online

You can also download the Wema Bank POS agent registration form.

Fill in the required details in the form carefully and correctly.

Go with the form and the required documents already listed above to any Wema Bank branch nearest you.

Your application will be documented, and they will give you further instructions on how to proceed.

Baxi Box

Baxi Box is one of Nigeria’s leading names in the fintech and agency banking PoS sphere. They provide the typical cash-in/cash-out business plus a host of other value-added services like bills payments, money transfers, airtime recharge, etc.

As a Baxi Agent, a cautionary fee of N10,000 for the Baxibox Mpos and N30,000 for Baxi Box android POS applies also. Baxibox POS also charges N30 flat for cash deposits and 0.55% on a single withdrawal transaction of N1 – N20,000. The percentage goes slightly higher as the withdrawal amount increases.

Requirements For Getting a Baxi Box POS.

- A verifiable Identity card – International Passport, National ID Card, or Voters Card

- Utility Bill

- Business registration certificate

- Bank Verification Number

- Bank account number

- Valid email address

- Passport photograph

How To Become a Baxi Box Agent.

- Download the BaxiMobile App from your play store/Apple store.

- Install the app on your device and complete the sign-up process

- Provide your BVN and verifiable address to upgrade your account to Baxi Flex or Baxi Pro.

- Navigate to Request for MPOS/POS and submit a request for a POS device.

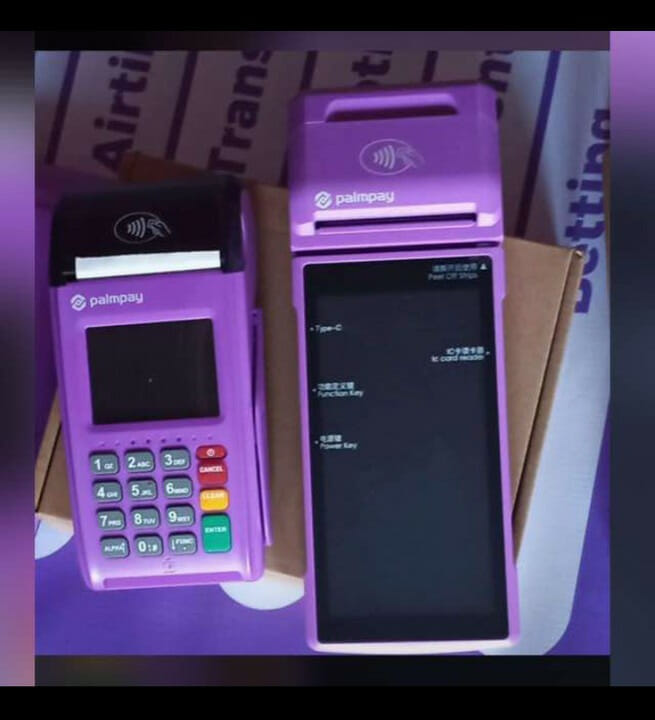

Palmpay

PalmPay POS is a service launched by PalmPay to let interested customers make money just by offering financial services such as withdrawal, cash deposit, transfers, etc, to other customers.

Requirements For Getting a PalmPlay POS Machine.

A verifiable ID card such as International Passport, National ID Card, or Voters Card

Utility Bill

Business registration certificate (For registered businesses only)

BVN

Bank Account Number

How To Request For a Palmpay POS Machine For Your POS Business.

Download the PalmPartner app from iOS or Android Playstore

Complete the application form in the app

Agree to the terms and conditions

Upload the required documents and submit them.

PalmPay PoS Charges And Commission Structure

Palmpay is one of the most structured PoS service providers in Nigeria. Some of the charges are:

- 3% of the amount for Airtime top-up

- N10 only for bank transfers

- Bill payments are for FREE.

Bankly

Bankly is a Nigerian Fintech company that provides a virtual saving wallet for the informal sector of Nigeria. Bankly charges 0.3% for POS withdrawals and a flat rate of N35 for all transfers. In addition, you will be charged 5 naira for every 1000 naira that you withdraw on behalf of a customer. Signing up to be a Bankly agent is free and the duration to become one takes within a week. Bankly would require the following documents for prospective PoS agents:

- A valid means of identification

- Utility bill /PHCN bill

- Business certificate for registered business

- Bank account number

- Bank Verification Number (BVN)

- Email address

To Request for Bankly POS machine, follow these steps:

- To become a Bankly POS agent, download the Bankly Agent mobile application.

- Create an account with Bankly by signing up in the mobile app and providing the KYC details They must verify your account before you proceed with registration. Bankly support personnel will do the verification.

- Log in to the app and start your transactions.

- From the mobile App, you can request for a PoS Machine.

Bankly POS is N25,000 (N10,000 of this amount is refundable in case you want to return the POS as long as the POS is in good condition).

Moniepoint PoS

Moniepoint, is a fast-growing mobile money platform, provides banking solutions that enable businesses to collect payments, access loans, manage operations and ultimately grow their business. Moniepoint offers its agents fair charges and commissions so that they can make a good profit from the POS business. Moniepoint’s transaction charges are considerably low and one of the cheapest in Nigeria. Charges are based on the number of transactions you carry out across all banks. There is a fixed charge of N20 for all banks in Nigeria.

Requirements To Become a Moniepoint PoS Agent.

- Business registration certificate.

- Your BVN

- Utility bill

- A Functional bank account Number

- Legitimate Means of Identification: National ID, Voters card, Int’l passport, etc.

How To Become a Moniepoint POS Agent.

- Visit Moniepoint’s official website.

- Fill out the registration form for Moniepoint agents and submit it.

- Register your email address and phone number, after which an agent will reach out to you after 48 hours of registration.

- The Agent would provide you with information on what to do next, after which they would confirm you as an agent

- You can now log in to your Moniepoint POS dashboard to manage your account.

- You can also do the registration at a Moniepoint branch. An officer will guide you on the process of registration.

The Moniepoint POS machine is not very expensive, it is an affordable sum of N25,000, which is cheaper than the cost of other POS machines.

Nomba PoS

To become a Nomba PoS agent is completely free.More so, there are no requirements to start except using the App for a while. All you need to do is sign up to the app by making use of your contact details and connecting the app to your bank account. Nomba charges 0.7% flat on cash withdrawals.

How to become a Nomba PoS Agent

- Download the Nomba app from the app store.

- Open an account with Nomba by signing up with your phone number

- Connect the Nomba app to your functional bank account

- Start transactions after funding your e-wallet

- Keep using the application for transactions such as airtime recharge, TV subscription and electric bills

- After about two weeks, Nomba will message you about your eligibility to receive a free PoS.

- You can now check your inbox or enquire about your eligibility for a free PoS.

- Rather than waiting for eligibility, you can simply go to their nearby office, or call their customer care.

For people living in Lagos Nomba, you can visit their office situated at 19b Bosun Adekoya Street in Lekki Phase 1. There, kindly request for the agent’s form, fill in your correct details and submit it to them. They will have to pay a non-refundable sum of 20,000 NGN immediately for the PoS device.

Summary

There are still many PoS service providers in Nigeria not limited to our list. The most important thing is to make to ask questions from authorised personnel or existing PoS agents on requirements, Pros and Cons of such service provider, Terms and Conditions of the service provider, capital needed to start, and commision to be recieved.

Discussion about this post