Different shares are worth different amounts of money. A share’s value will vary depending on whether you’re looking at its fair value or its market value. The fair value is the intrinsic value of a stock, while the market value is the amount that individuals are currently willing to pay for the stock.

The fair value of a stock is often much lower than the market value as the latter is heavily influenced by demand, which does not always reflect a share’s fundamentals. If the demand for a share goes up while the supply remains constant, then the share price will rise as people are willing to pay more.

The fair value of a stock is often much lower than the market value as the latter is heavily influenced by demand, which does not always reflect a share’s fundamentals. If the demand for a share goes up while the supply remains constant, then the share price will rise as people are willing to pay more.

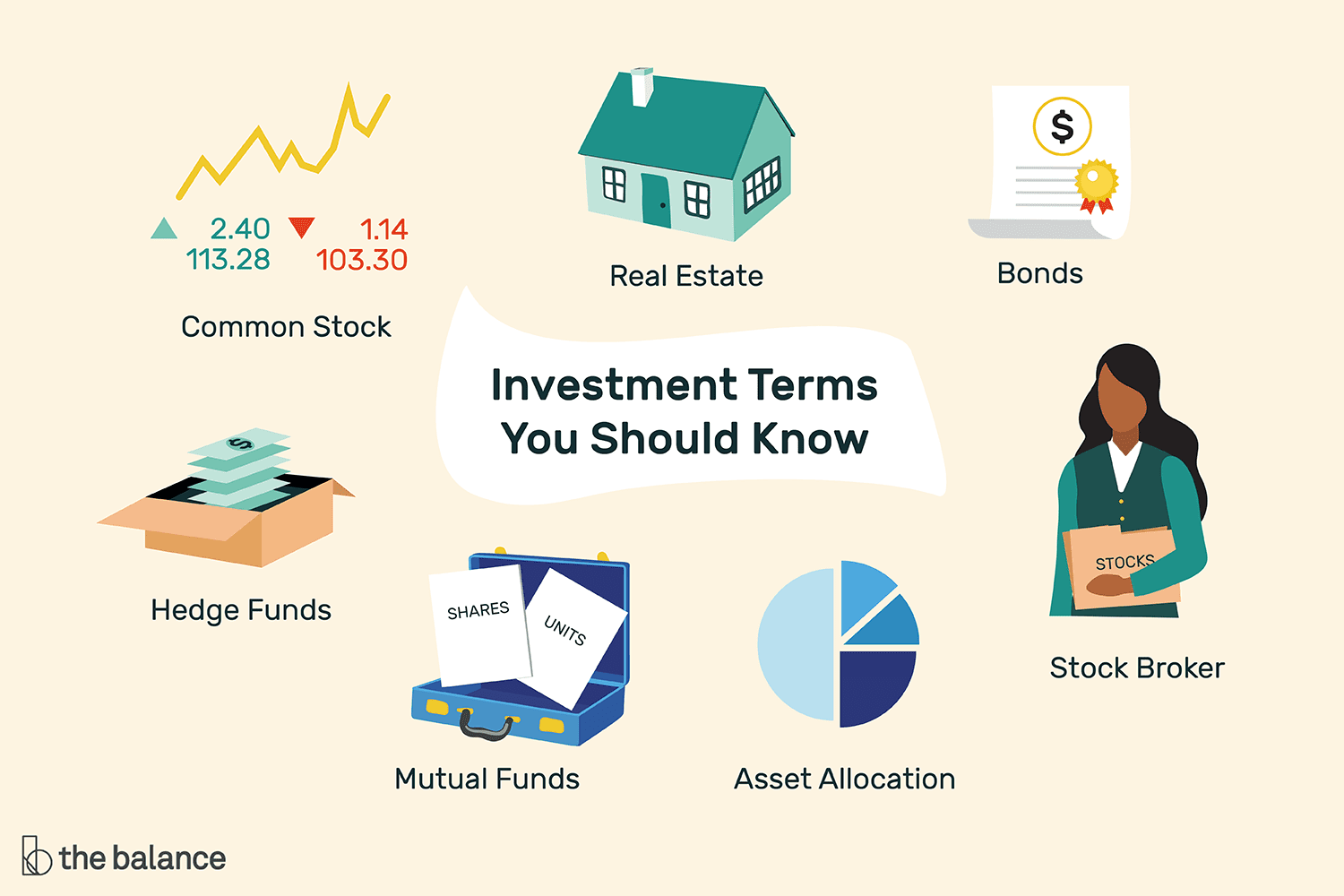

Who is a Stockbroker

A stockbroker is a person or firm that acts as a middleman between you and the stock market. Apart from helping an investor trade, stock brokers also offer financial advice,offer access to deliverables, options, mutual funds, ETFs, as well as portfolio management.They are usually highly experienced and have access to up-to-date information on the stock market

Before an individual can identify as a stockbroker, he or she must have the relevant accreditation to facilitate the purchase and sale of stocks in the Nigerian Stock Exchange.

DIY – Investing in Shares yourself without the need of a stockbroker

These days, investing in shares has been made easier with the help of online stock brokers. Prior to this, it was carried through brokers who placed buy/sell orders on your behalf. The difference in both platforms – online breakage platforms and offline are highlighted in four major things:

- Trading

- Convenience

- Fraud & Privacy

- Expertise & Knowledge

Trading:

With an online share trading platform, the users can place their own orders. On the other hand, an offline account means that users need to avail the services of a broker to place orders. Instructions are specifically given to the brokers in an offline trade, which creates dependence on the broking agency. Such dependence is non-existent when you choose to trade through an online account.

Convenience:

An online stock trading account is a good option for people who have an Internet connection and track their orders from the convenience and comfort of their homes or offices. In case users are not able to access stock broking sites or do not have access to an Internet connection, placing orders on the phone with their brokers is more advisable.

Fraud & Privacy

Because online share trading provides users complete control over the transactions, the risk of potential frauds is eliminated. There are certain instances when the brokers execute trades on behalf of their clients without receiving permission, which can cause significant losses to the users who choose offline trading.

Expertise and Knowledge:

When users opt for an online stock trading account, they may get carried away. Without doing proper research and understanding more about how the stock market works, they may buy or sell shares, which can result in huge losses. This is avoidable with offline trading because the brokers have several years of experience and knowledge, which can be beneficial for users as they receive accurate guidance through the broking service providers. Fortunately, most of the agencies that offer online trading services offer access to research reports and other technical and fundamental analyses to assist account-holders to gain a deeper understanding to make the right investment decisions.

Excuses that prevent people from making money from stocks

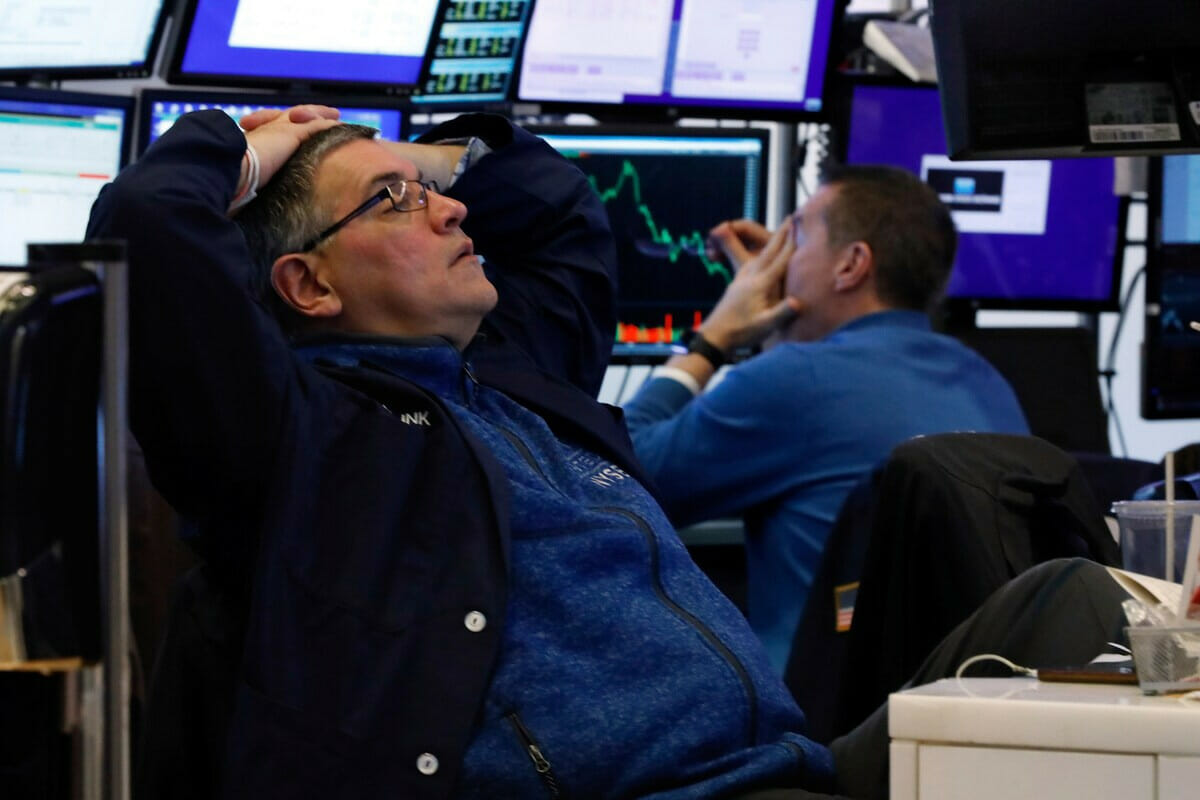

The stock market is the only market where the goods go on sale and everyone becomes too afraid to buy. That may sound silly, but it’s exactly what happens when the market dips even a few percent, as it often does. Investors become scared and sell in a panic. It’s a perfect recipe for “buying high and selling low.”

To avoid both of these extremes, investors have to understand the typical lies they tell themselves. Here are three of the biggest:

‘I’ll wait until the stock market is safe to invest.’

This excuse is used by investors after stocks have declined, when they’re too afraid to buy into the market. Maybe stocks have been declining a few days in a row or perhaps they’ve been on a long-term decline. But when investors say they’re waiting for it to be safe, they mean they’re waiting for prices to climb.

What drives this behavior: Fear is the guiding emotion, but psychologists call this more specific behavior “myopic loss aversion.” That is, investors would rather avoid a short-term loss at any cost than achieve a longer-term gain. So when you feel pain at losing money, you’re likely to do anything to stop that hurt. So you sell stocks or don’t buy even when prices are cheap.

‘I’ll buy back next week when it’s lower.’

This excuse is used by would-be buyers as they wait for the stock to drop. But as the data from Putnam Investments show, investors never know which way stocks will move on any given day, especially in the short term. A stock or market could just as easily rise as fall next week. Smart investors buy stocks when they’re cheap and hold them over time. What drives this behavior: It could be fear or greed.

‘I’m bored of this stock, so I’m selling.’

This excuse is used by investors who need excitement from their investments, like action in a casino. But smart investing is actually boring. The best investors sit on their stocks for years and years, letting them compound gains. Investing is not a quick-hit game, usually. All the gains come while you wait, not while you’re trading in and out of the market.

Understand the risks in shares investment

Shares can be a sound long-term investment but of course there are always risks to be considered as with any type of investment. Risk is the potential of losing some or all of our money. Generally, all forms of risks are influenced by these three factors, and they include the following:

Volatility

Share values can be volatile and can fall dramatically in price, even to zero. Many things determine the fall of share price such as economic performance, policies, market speculations, etc.

Credit Risk

The kind of shares bought also determines which kind of risk will be involved. Owners of ordinary shares are generally the last in the line of creditors if a company fails and there may be no chance of getting any money back.

Unexpected Events

Unexpected events which are outside of your control, such as company specific bad news, a change in government policy or natural or man-made disaster can seriously affect share price.

Risk also differs in trading of shares and investing. Trading can be seen as riskier than investing, mainly due to the use of leverage and expertise. Investing also carries a risk – and there’s no guarantee that your investments would increase in value, so you could receive back less than you initially invested.

How to manage Risk

It’s generally not a good idea to put all our money into a small number of, or very similar, investments. It’s better to spread investments in shares across different companies, industries and countries, as well as buying other asset classes such as bank deposits, bonds, and property. This is called diversification. Here are the important concepts to master before you get started:

- Diversify your portfolio.

- Invest only in businesses you understand.

- Avoid high-volatility stocks until you get the hang of investing.

- Always avoid penny stocks – stocks with low share prices

- Learn the basic metrics and concepts for evaluating stocks.

Discussion about this post